ANALYSIS: Democrats tap gaming cash cow to help fill state budget gap

By HANNAH MEISEL

Capitol News Illinois

hmeisel@capitolnewsillinois.com

SPRINGFIELD – In order to boost infrastructure spending and avoid a projected fiscal cliff facing the state in the next couple of years, Democrats who control state government are betting on two of its most rapidly growing revenue sources: sports wagering and video gambling.

The industries – both legalized within the last 15 years – have developed into two of the most robust markets in the nation; Illinois’ sportsbooks collectively have the fourth-largest handle among all states, while Illinois’ video gambling industry is by far the largest of any state.

When proposing his budget plan in February, Pritzker suggested increasing taxes only on sports betting. But despite pushback from some Democrats – and the sportsbooks’ massive spend on lobbying to kill the tax hike – the governor got above and beyond what he’d requested from the legal gambling industry, even as some of his other proposed new revenues were left on the cutting room floor in the final weeks of the General Assembly’s spring legislative session.

Read more: Pritzker proposes over $2B in spending growth, backed by tax increases for corporations, sportsbooks

In the end, Illinois’ growing video gambling industry will see a 1 percentage point tax hike that’s estimated to bring in another $35 million next year for infrastructure projects. Meanwhile, the state’s burgeoning sports betting industry will see a more substantial increase in taxes from a flat 15 percent rate to a graduated structure ranging from 20 percent on the lowest-earning sportsbooks to 40 percent for the highest earners.

The change is projected to generate an extra $200 million, which will be directed to the state’s General Revenue Fund, Illinois’ main discretionary spending account.

Those promised windfalls would bolster already sizeable sources of revenue for the state. In the fiscal year that ended June 30, 2023, Illinois netted $142 million in taxes from sportsbooks, while video gambling terminals in bars, restaurants and dedicated gaming cafes generated $814 million.

Taken together, the two made up almost half of the near-$2 billion the state took in from all forms of wagering last fiscal year, which also includes growing revenues from the state lottery and casinos.

Organized labor, a top funder and ally for Democrats, balked at the plan to deposit the extra tax dollars from sportsbooks into GRF instead of dedicating it to infrastructure projects, where current sports betting revenues are directed. And major sportsbook operators threatened to stop advertising or even withdraw from the state as the legislature’s scheduled adjournment date drew near last week.

But Pritzker was undeterred, pointing consistently to East Coast states like New York and three others, which have all implemented tax rates over 50 percent on their online sportsbook operators. Before the tax hike’s passage last month, the governor brushed off opposition, saying the sportsbooks “have made literally tens of millions of dollars from the state of Illinois,” later noting that the major sportsbooks subject to the highest taxes in the new graduated structure “don’t reside in the state of Illinois.”

“Our focus was on asking…companies that can pay more to pay more,” he said after the tax increase’s passage last week. “And indeed, we kept the tax on sportsbooks lower than the top states in that arena.”

In pushing the tax hikes through the General Assembly, the governor and legislative Democrats are making a bet that sports betting and video gambling companies need Illinois as much – or more – than Illinois needs their tax revenue.

Sports betting

Under the new tax revenue package, sports betting revenues going forward will be split between the state’s General Revenue Fund (58 percent) and Capital Projects Fund (42 percent).

Pritzker’s office predicts the graduated structure will bring in the same $200 million extra for GRF that increasing the flat tax would have.

Sportsbooks’ new tax rates will depend on their annual revenues.

Earnings below $30 million annually will be taxed at 20 percent.

Earnings between $30 million and $50 million annually will be taxed at 25 percent.

Earnings between $50 million and $100 million annually will be taxed at 30 percent.

Earnings between $100 million and $200 million will be taxed at 35 percent.

Earnings above $200 million will be taxed at 40 percent.

The final plan marks an evolution from Pritzker’s February proposal, which sought to increase the state’s current 15 percent tax on sports betting operators to 35 percent.

But not all Democrats were on board with the governor’s idea, with some expressing concerns about overleveraging a nascent industry, which has threatened to stop advertising or even operating in Illinois if the tax hike is passed.

A nationwide industry group dubbed the Sports Betting Alliance, which represents both big players and emerging sportsbooks, launched a campaign against the tax increase that generated more than 56,000 emails and calls to the governor’s office and lawmakers, according to a representative for the group. Last month, sportsbook giant FanDuel pushed alerts to its Illinois users via its app, urging them to take similar action.

“This tax hike will mean worse products, worse promotions, and inevitably, worse odds for Illinois customers – not to mention provide a massive leg up to dangerous, unregulated and illegal offshore sportsbooks who pay no taxes and adhere to none of Illinois’ sports betting regulations,” Sports Betting Alliance President Jeremy Kudon said in a statement.

The sportsbooks contend that they earn only a small amount of every dollar wagered, as the rest is paid out in winnings. From that small amount, they say, everything from payroll to marketing must be paid – including taxes.

Sportsbooks claim taxing them more could backfire as they may decide to spend their marketing dollars in other states, and without special promotions to entice the casual and occasional bettors, those users could drop off entirely.

In House floor debate over the revenue package that contained the sports betting tax hike, state Rep. Will Guzzardi, D-Chicago, said the reach of the sportsbooks was drilled into him while watching the NBA playoffs.

“It seems like every other commercial I see is from one of these sportsbooks, and they’ve got celebrities and they’re buying up all these timeslots,” he said. “I guess I’m hard-pressed to think of DraftKings and FanDuel as small mom-and-pop Main Street Illinois businesses that are struggling to get by.”

Like in many other states, DraftKings and FanDuel have cornered roughly three-quarters of Illinois’ sports betting market. Their ability to do so was aided by unforeseen circumstances created by the COVID-19 pandemic.

Illinois became the 15th state to legalize sports betting as part of a massive gambling expansion law passed in 2019. Lawmakers, sports enthusiasts and gambling interests had been champing at the bit to legalize sports wagering for a year prior to its passage after a U.S. Supreme Court decision striking down a federal ban on the industry outside of Nevada, which had been grandfathered in.

Though the law that legalized sports betting in Illinois had intended for casinos to get an 18-month head start in the sports betting market before big online operators like DraftKings and FanDuel became licensed, those companies got around the law by partnering with downstate casinos to operate their sportsbooks.

They were also helped by Pritzker’s COVID-era suspension of the law’s requirement for in-person registration at casinos, allowing bettors from hundreds of miles away to start gambling almost as soon as they downloaded a certain sportsbook’s app.

The first bets were placed at Rivers Casino in Des Plaines on March 9, 2020, just days before the COVID-19 pandemic shuttered both professional sports nationwide and gambling activity in Illinois.

Even so, by the end of 2020, Illinois’ overall handle – the amount bettors spent wagering – had launched to fourth among states, and it’s consistently stayed that high ever since.

The industry has generated $415 million in tax revenue for the state in the four years since the market launched, according to the Illinois Gaming Board’s latest available data, which is current through the end of March 2024.

The rate of growth in wagers and the corresponding growth in tax revenue has slowed from its initial explosion, but still grew 23 percent between the third and fourth years of legal sports betting in Illinois.

Online wagering is infinitely more popular than placing bets at a “retail” sportsbook like a casino or pro sports stadium. According to a September report by the Commission on Government Forecasting and Accountability, 98.8 percent of all wagers in Illinois were made online in the fiscal year that ended in June 2023.

Tax revenues reflect that disparity. Illinois Gaming Board records show tax receipts made from online bets netted the state nearly $399 million in the last four years, compared with just $16 million from in-person bets.

That dynamic is echoed in other states that have legalized both online and in-person betting, meaning it’s most useful to compare states’ online sportsbook markets. Since Illinois launched its market, 21 other states and the District of Columbia have launched their online sports wagering markets.

At the time Illinois’ market launched four years ago, the state’s 15 percent tax rate was on the higher end of those that came before it, but nowhere near the 36 percent rate in Pennsylvania or the 51 percent tax adopted imposed by both Rhode Island and New Hampshire on online sportsbooks.

But since then, several more states have launched their online markets with tax rates higher than Illinois’ 15 percent, including Delaware at 50 percent and New York with a 51 percent tax on online operators.

Ohio became the first state to hike its sports betting tax last year when Republican Gov. Mike DeWine pushed to double the state’s tax rate from 10 to 20 percent just six months after its market launched, though he insisted it was motivated by concern over sportsbooks’ aggressive advertising, and not a revenue decision. New Jersey lawmakers are also weighing hiking its tax on online operators from 14.25 to 30 percent.

Despite other states taking similar steps to Illinois, the companies threatened to push the nuclear button in the final days of session, with a source close to DraftKings and FanDuel telling Capitol News Illinois that “all options are on the table, including withdrawing from the state.”

But skeptics say the companies are making more from Illinois’ market than they let on, especially as parlay bets – multiple wagers bundled together into one bet – have overtaken any other sort of bet in popularity, upending models that were used to arrive at Illinois’ 15 percent tax rate during negotiations five years ago. Parlay bets made up more than 60 percent of all sports wagers made in fiscal year 2023, according to state records.

Because bettors are more likely to lose their parlay bets than straight bets like on the outcome of one game or a point spread, the sportsbooks earn much more from these riskier bets. Sportsbooks also promote parlay bets, often enticing bettors with offers to make the parlays.

Sportsbooks – particularly ones focused on their retail operations – did end up getting a tiny concession in a last-minute amendment before lawmakers OK’d the new tax structure this week. Revenues made from in-person bets will be differentiated from revenues made from online wagers before they’re taxed, meaning overall revenues will be slightly slower to cross higher tax thresholds in the graduated structure.

Unused licenses

State Rep. Bob Rita, D-Blue Island, a lead sponsor of the 2019 law that ushered in sports betting, was not buying the doomsday threats from the sportsbooks.

“Nope,” he told Capitol News Illinois when asked whether he felt the sports betting companies’ complaints had merit.

Instead, Rita said, lawmakers should focus on the number of sportsbook licenses made available under the 2019 law that still haven’t been awarded. He speculated there could be many reasons sports betting companies haven’t tried for the three online-only “master” licenses or six of the seven tied to sports venues.

Before session ended, a House committee focused on gaming issues convened just such a hearing, in which committee members were told the license fees were far too high. Rita asked those testifying to the panel to identify problems in the current law that allowed the licenses to go unused.

John D’Alessandro, representing the ownership of the Chicago Wolves minor league hockey team, said the organization had mostly stopped pursuing a venue-specific sports betting license because the team would likely never see a return on the $10 million investment in a license fee – especially because bets could only be placed in person or within a roughly five-block radius of the venue.

“It’s very overpriced in the market,” he said of licenses compared with those in other states. “You have a very high fee, you have no online capabilities…the economics don’t make sense.”

Only DraftKings has pursued a venue-specific sportsbook. Last summer, it opened a 17,000-square-foot space adjacent to Chicago’s Wrigley Field offering bar and restaurant service to customers while it awaited final licensure from the Gaming Board, which came in March.

Illinois’ license fees are some of the highest in the nation. Pennsylvania also charges $10 million for an initial license fee and New York charges a $25 million fee for online operators, other states charge in the hundreds of thousands, or even have no license fees. New York does not charge land-based sportsbook operators a license fee or charge for renewals, while Illinois charges $1 million every four years for license renewals.

A representative from the state’s Gaming Board testified that only one sportsbook has even applied for the $20 million online-only master sports betting license but ended up withdrawing.

Video gaming

Taxes on Illinois’ ever-growing video gambling industry will grow to 35 percent – up from the 34 percent rate it’s been sitting at since 2020.

That extra tax would generate an estimated $35 million next year, according to estimates from Pritzker’s office. The $814 million in taxes video gambling terminals generated for the state in the 2023 fiscal year is part of $4.8 billion the industry has made for state infrastructure projects since the very first gaming terminals launched in 2012, according to the Illinois Gaming Board.

Upping the tax on video gaming was a last-minute addition to Democrats’ revenue package in recent days; Pritzker had not mentioned any desire to do so earlier this spring.

The 2009 law that legalized video gambling implemented a 30 percent tax on the industry and limited most establishments to five terminals apiece. But as part of a massive gambling expansion in 2019, the General Assembly upped the tax to 33 percent with an automatic bump to 34 percent in 2020.

In exchange, restaurants, bars and gaming cafes have been allowed to add a sixth terminal, while so-called “large truck stops” were allowed to install up to 10 machines. In addition, the maximum bet for each hand doubled from $2 to $4.

Despite the pandemic shutting down video gaming terminals for months at a time in 2020 into 2021, the industry’s growth was undeterred, with revenues rebounding to near-double pre-COVID levels by the end of last fiscal year.

Nearly 46,000 video gaming terminals were in operation statewide at the end of the 2023 fiscal year, according to state records. On average, 238 new terminals came online each month last year.

Though the video gambling industry balked at the proposal to once again hike taxes on its terminals, a last-minute counterproposal to allow bars and restaurants to increase the maximum number of terminals to seven didn’t pan out.

Photo by Amit Lahav, unsplash.com.

Capitol News Illinois is a nonprofit, nonpartisan news service covering state government. It is distributed to hundreds of print and broadcast outlets statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation, along with major contributions from the Illinois Broadcasters Foundation and Southern Illinois Editorial Association.

Local News

Funds flow to Back of the Yards

Spread the loveFour groups get grants; millions more available By Tim Hadac Four organizations in Back of the Yards—three businesses and a non-profit—are among 31 awarded more than $14.4 million in small business grants being allocated through the Chicago Recovery Plan. They are: Diaz Group Office Space, 5100 S. Damen, $250,000. El Nuevo Guadalajara, 4350…

Offer reward in grandma’s slaying

Spread the loveWas shot on 71st Street By Tim Hadac A $15,500 reward is offered for information leading to the arrest and conviction of whoever shot and killed a 49-year-old grandmother in the Chicago Lawn neighborhood. Tamiko L. Talbert Fleming, of south suburban Dolton, was in the driver’s seat of her vehicle at 71st…

A sweet salesgirl

Spread the love Alessandra Valentina Paredes, a Daisy Scout with Girl Scout Troop 20637 (sponsored by St. Nicholas of Tolentine Parish), shows a sweet smile as she begins her first-ever time selling Girl Scout Cookies. The daughter of West Lawn residents Jose Antonio and Lorena Paredes, Alessandra, age 5, joined the Daisies just four months…

Midway is new for Frontier

Spread the loveLow-fare airline coming in April By Tim Hadac Low-fare passenger airline options are set to increase at Midway International Airport this spring, with the arrival of Frontier Airlines. The expansion of air travel options was announced at a press conference last week at the airport. With 10 new nonstop routes taking off starting…

Rush rips USDA over plight of black farmers

Spread the love‘House is on fire,’ congressman says From staff reports U.S. Rep. Bobby L. Rush (D-1st) recently questioned U.S. Department of Agriculture Secretary Tom Vilsack about what Rush called “the dire prognosis of black farmers in the U.S. and the steps USDA is taking to help minority farmers.” “As you well know, our nation’s…

Charge man with Archer Heights carjacking

Spread the loveBy Tim Hadac Police say they’ve solved a carjacking that occurred in Archer Heights earlier this month. An 18-year-old Southeast Side man was charged with aggravated vehicular hijacking in connection with the crime. Monte Handley, of the 9000 block of South Muskegon, was apprehended by police in the 7500 block of South Ellis…

Charge man in shooting of 2

Spread the loveBy Tim Hadac A 22-year-old West Lawn man was charged with two counts of aggravated battery, as well as aggravated unlawful use of a weapon, after he was arrested in the 3700 block of West Marquette Road at 4:06 p.m. Monday, Jan. 17. Isaiah Barco allegedly shot two men in a crime that…

Many crimes down in Orland, but weapons arrests concerning

Spread the loveBy Jeff Vorva Orland Park Police Chief Joseph Mitchell had mostly good news when revealing the village’s 2021 crime statistics. But one glaring area that has him bothered is the number of unlawful use of a weapon arrests that have been shooting up. Mitchell and Mayor Keith Pekau attribute it to felons from…

Former GOP allies to battle for county board race

Spread the loveGorman wants to reclaim seat from Morrison By Bob Bong A battle royale is brewing in the race for the Republican nomination for Cook County Board’s 17th District. The 17th District is one of only two county board seats held by Republicans and it has only ever had a Republican commissioner dating back…

Neighbors

Worth limits number of signs on businesses

Spread the loveBy Joe Boyle Signs that are attached to businesses in Worth will undergo a makeover. A lengthy discussion took place during the Worth Village Board meeting Tuesday night addressing a dilemma that trustees said had to be addressed. An ordinance was drawn amending previous sign regulations of businesses in the village. Trustees had…

Help is available for crime victims

Spread the love. By Peggy Zabicki Your correspondent in West Lawn 3633 W. 60th Place • (773) 504-9327 . The Chicago Police Department will present a program called Crime Victim Services on Wednesday, July 10 from 2 to 6 p.m. at the West Lawn Branch Library, 4020 W. 63rd St. The police will provide support…

Neighbors—and dogs—pleased with new trees

Spread the love. By Mary Stanek Your correspondent in Archer Heights and West Elsdon 3808 W. 57th Place • (773) 517-7796 . Now that it is mid-July, I wonder when the pumpkin lattes will start appearing? My side of the West Elsdon neighborhood got a little greener on June 27th. Trees were planted along 58th…

Palos Park teen violinist invited to perform at Ravinia Festival

Spread the loveBy Kelly White A Palos Park teenager who is a member of the Suburban Youth Symphony Orchestra has been invited to perform at next week’s prestigious Ravinia Festival. Violinist, Mariah Saban Rice, 13, of Palos Park, is one of three south suburban musicians invited to attend and perform at the National Seminario Ravinia…

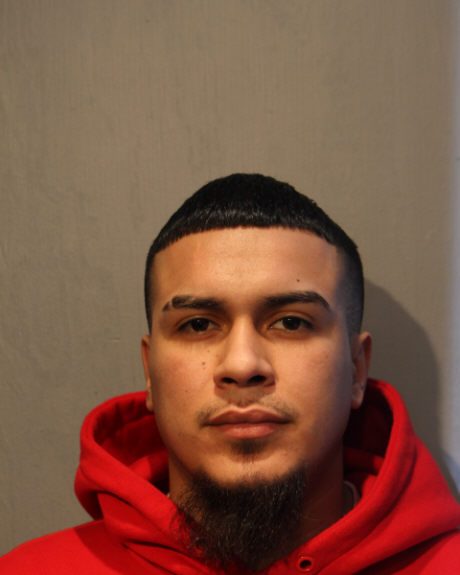

Palos Park police charge Burbank man for false fire alarms

Spread the loveFrom staff reports A Burbank man was charged Monday with six counts of felony disorderly conduct for his role in allegedly setting off false fire alarms dating back to March. Palos Park police said they initiated an investigation on March 18 after they were contacted by the Palos Fire Protection District regarding numerous…

Red Stars’ Swanson, Naeher headed to Paris seeking gold

Spread the loveBy Jeff Vorva Correspondent Two Chicago Red Stars standouts are going to Paris to represent the U.S. in the Summer Olympics. Goalie Alyssa Naeher and forward Mallory Swanson have been named to the United States Women’s National Team. Naeher was on U.S. Olympic teams that played in Rio de Janeiro and 2016 and…

Laurie Markatos, Dylan Jacobs looking toward 2028 Summer Games

Spread the loveBy Jeff Vorva Correspondent Laurie Markatos predicted there would be a “flood of tears” her first day on the job. Markatos, The Regional News and The Reporter’s Softball Player of the Year in 1996 and 1997 when she played for Stagg, is an assistant coach of the Greek National Softball Team, also known…

Township of Lyons donates $10,000 to help food pantries

Spread the loveBy Steve Metsch The Township of Lyons board was in a giving mood at its most recent meeting. The board approved sponsorships and donations totaling $12,250. The largest donation was $10,000. It went to the Greater Chicago Food Depository which runs 12 monthly mobile food pantries in the township each year. Supervisor Christopher…

Countryside zoning commissioner honored for 20 years on board

Spread the loveBy Steve Metsch For the past 20 years, Tina Grotzke has had a say-so in every development that’s come to Countryside. Grotzke was appointed to another term on the city’s the plan commission zoning board of appeals during the city council’s meeting on June 12. Mayor Sean McDermott noted Grotzke’s two decades of…