From Better Government Association: Illinois Medicaid companies rake In record profits from pandemic

By DAVID JACKSON

Better Government Association

The for-profit insurance companies running Illinois Medicaid collected hundreds of millions of dollars in extra profits during the COVID-19 pandemic — much of it for services never provided to patients, an investigation by the Better Government Association has found.

The windfall was the result of a payment system based on annual, per-patient estimates. While the number of patients in the state’s Medicaid program swelled as people lost their jobs, many deferred elective medical procedures during the pandemic.

That meant the insurance companies spent a smaller percentage of their government revenue on direct medical services, a trend seen nationwide in which Medicaid providers made billions in extra profits.

An analysis of the quarterly and year-end financial statements of Illinois’ five Medicaid insurance contractors — called managed care organizations, or MCOs for short — reveals the unprecedented surge in profits from April 2020 through December 2020. The Illinois COVID-19 lockdown began in March when Gov. J.B. Pritzker issued executive orders closing schools and some businesses.

Three of the Medicaid companies — Meridian Health Plan of Illinois, IlliniCare Health Plan and Molina Healthcare of Illinois — reported a combined $282 million increase in profits in Illinois during that nine-month stretch when the pandemic was at its height, compared to the same period in 2019.

The other contractors — insurance giant Blue Cross and Blue Shield of Illinois and Aetna Better Health of Illinois, Inc. — also reported large profits on a national scale, but the direct correlation is unclear because their figures include private patients, Medicare recipients or data from other states.

The parent company of Illinois’ Blue Cross — which covers the insurance carrier over five states — reported its net income from all private and public plans rose by 75% to nearly $4 billion last year, records show.

Presented with the BGA’s findings, the top official at the Illinois Department of Healthcare and Family Services said her office will investigate and work to recover some of the taxpayer money as part of a routine statewide accounting due in 2023.

“I don’t think it is fair to take a partial-year look or a short-term look at something when all these numbers and all these projections are annual in nature, and there’s still a lot of billings and reporting and reconciling to do,” said Theresa Eagleson, director of HFS in an April interview with the BGA.

“If those numbers for calendar year 2020 end up bearing out, we will be recouping a significant amount of money from the plans,” Eagleson said. “I’m not saying that we don’t see this potentially occurring. I’m saying we don’t have a process in place to recoup it until … all the information is in.”

In a followup email earlier this month, Eagleson’s top spokeswoman said, “purely as a snapshot in time, initial incomplete figures indicate HFS would recoup over $120 million” from the insurance firms for calendar year 2020. Those funds will come through a program called a “risk corridor” that reallocates money if the companies exceed or fall short of targets for medical care.

“Illinois was one of the first states in the country to implement risk corridors during the pandemic to further restrict possible profit margins,” said Jamie Munks, Eagleson’s spokeswoman. “We will recoup more from the health plans than we otherwise would have.”

The prospect of waiting two years for payback isn’t fast enough for some state lawmakers. State Sen. Dave Koehler, a Democrat from Peoria, in December filed a bill to “claw back” 20% of all COVID-era profits from the Medicaid providers.

“Our two hospital systems here in Peoria verified that their revenues were down during the height of the pandemic because everybody was not doing electives,” Koehler, an assistant majority leader, told the BGA. “That bothers me.”

When his bill wasn’t progressing to a floor vote, Koehler said he met for 45 minutes with Pritzker in March and made his case to recover 20% of the excess profits now.

“I said, ‘We don’t really have a managed care system in this state; we have a managed payment system. … There is no care,’” Koehler said he told Pritzker.

Koehler declined to discuss how Pritzker responded.

Email traffic obtained by the BGA through a public records request suggests the Pritzker administration had already decided to scuttle Koehler’s efforts.

“The governor’s office also has many concerns with the (bill) language,” wrote Samantha Olds Frey, the state’s top Medicaid insurance lobbyist, in an email to company leaders Jan. 5. “They asked that I send over our high level list of concerns, so they can review them and include them in their analysis.

“We are also working with HFS and our communications team to push back with the press,” Olds Frey wrote in a separate email to industry executives.

The emails illustrate the influence Medicaid contractors exert over Illinois agencies tasked with holding the insurance firms accountable for patient care and taxpayer savings, according to ethics and industry experts.

“It doesn’t seem to be just or fair to the taxpayers of Illinois that these billions of dollars in payments would continue to flow to the MCOs during a time when they’re not providing the services and the state has a significant budget problem,” said John Pelissero, a government ethics professor at the Loyola University Chicago, who reviewed the emails at the BGA’s request.

Renée Popovits, an attorney for Medicaid doctors and medical clinics who testified in March in favor of Koehler’s bill, told the BGA that the insurance firms “deserve to be adequately and appropriately compensated but not at this level of gross profits.” The corporations’ pandemic-era profits surged as Illinois’ health care system was reeling and officials struggled to vaccinate citizens and protect elderly and disabled adults, Popovits noted.

“How can the state shut down churches, schools and businesses in the name of a public health emergency yet feel no urgency to redirect this money?” she asked.

Olds Frey, who heads the Illinois Association of Medicaid Health Plans, said her collaboration with the Pritzker administration to combat Koehler’s bill helped ensure the solvency of the entire state Medicaid program.

“We continuously coordinate and calibrate with key stakeholders like the governor’s office, HFS, legislators, providers and members to ensure positive outcomes for Medicaid recipients,” Olds Frey responded in an email to the BGA.

Pritzker’s press secretary Jordan Abudayyeh declined to provide details but said the governor and his staff routinely solicit feedback from all sides as they analyze the pros and cons of any issue.

Nicole Huberfeld, a professor of health law at the Boston University School of Law, said the Illinois Medicaid contractors’ 2020 windfall profits could be erased by new expenses if citizens who deferred care soon demand it.

“Yes, there is an uptick of profits, but the MCOs are facing a potential rip tide of losses as COVID eases and people return to their doctors with pent-up demands for treatment,” Huberfeld said.

Three days after the BGA published this article, Koehler cited the BGA findings and called for legislative hearings into the insurance providers COVID-era Medicaid profits.

“If we are able to reallocate excess profits from these companies, we can help hospitals stay open and keep providing lifesaving care in our low-income and rural communities,” Koehler said in a May 27 press release.

Illinois began taking steps to privatize its modern Medicaid program in 2010 under then-Gov. Pat Quinn, a Democrat. Former Republican Gov. Bruce Rauner accelerated those efforts, which were embraced by Pritzker, a Democrat.

At the same time, consolidations reshaped the insurance sector focused on Medicaid. Today, a handful of publicly traded companies are in charge of one of the most vital functions of Illinois’ government: providing care to 2.6 million low-income people, including pregnant mothers, people with disabilities, nursing home residents and foster children, records show.

Before Medicaid was turned over to private insurance companies, the state paid each doctor, clinic or hospital a fee for every Medicaid service rendered. Today, the state pays the insurance firms a fixed dollar amount per member each month, whether the patient received costly treatments or no medical services.

Four of the five companies declined to respond to the BGA’s written questions or requests for interviews. Blue Cross said its financial gains were largely limited to the first months of the pandemic.

“During the first half of 2020, we saw sharp declines in elective care utilization, as consumers were reluctant or unable to seek medical care due to ‘stay at home’ measures,” said Blue Cross spokeswoman Colleen Miller. “In the second half of the year, the pendulum swung the other direction, and the deferral of care moderated with utilization levels eventually returning to nearly normal levels. During this period, benefit expenses also increased to cover pandemic-related costs, such as testing, diagnosis and treatment.”

Eagleson said the BGA’s analysis is incomplete because it is focused only on the nine COVID months of 2020. If the entire year is considered, the same three Medicaid insurance firms reported combined losses last year and in 2019. “In full context, it is plain that the plans are not making excess profits,” Eagleson’s spokeswoman wrote.

Those state-level losses to which Eagleson referred don’t reflect actual losses on a company-wide level because Illinois contractors pay hundreds of millions of dollars in management fees to their corporate parents.

For instance, Meridian Health Plan of Illinois Inc. reported a 2019 loss of $77 million — but only after paying a $287 million management fee to a subsidiary of its parent company, Centene Corp. Despite such state-level losses, Centene reported nationwide profits in 2019 of more than $1 billion, records show.

Illinois officials and industry lobbyists said they opposed Koehler’s clawback legislation because the state already has a mechanism in place to recover overpayments to the insurance companies. Under Illinois contracts, which totaled $16 billion last year, the insurance companies are required to spend 85% of all public revenues directly on medical services, leaving 15% for administrative costs, marketing, other expenses and profits.

That 85% rule has come under scrutiny in recent years because of the state’s poor record enforcing it, loopholes in what constitutes medical services, and the state’s lack of transparency about how it holds the insurance companies accountable.

The Illinois Auditor General found in 2018 that the state failed to account for the 85% rule for three years between 2012 and 2015. HFS acknowledged the failure and retroactively collected $90 million in excess payments stretching back to 2011, according to data HFS provided to the BGA.

Critics of Illinois’ Medicaid system also said the state allows the insurance providers to meet the 85% rule by counting vaguely defined activities, such as “quality improvement,” as direct medical expenses.

During 2019, for instance, Illinois’ five Medicaid insurance firms claimed they spent a combined $336 million on quality improvement, records show. Absent that expense, two of them would have fallen short of the 85% ratio and been forced to remit millions of dollars, state records showed. IlliniCare and Aetna, two of the five companies, recently merged.

The HFS’ Eagleson said Illinois raised its ratio to 90% during the COVID-19 period last year to make sure taxpayers weren’t being fleeced.

Several other states told the BGA they have already begun to recover undeserved profits from Medicaid providers.

South Carolina currently estimates it will recoup $75 million from its far smaller $3.3 billion program following an audit of last year’s spending. “These numbers are not finalized and are just approximate totals based on incomplete data,” John Tapley, the state Medicaid program manager, told the BGA.

Minnesota estimates that nearly $78 million may be returned by the MCOs running that state’s $7 billion Medicaid program in 2020, said Sarah Berg, spokeswoman for the state’s Department of Human Services.

New Jersey won federal approval to amend its managed care contracts and estimates it will save $400 million for the period of January through June 2020, said Tom Hester, communications director of the state’s Department of Human Services.

Illinois’ five Medicaid contractors all were subsidiaries of publicly traded insurance companies that compete to care for low-income people in states across the U.S. Their COVID-19-era profits were driven by a confluence of factors, government and industry officials said.

The shutdown of Illinois’ economy swelled the state’s Medicaid rolls by 480,000 people as workers lost their jobs and lost their employer-sponsored insurance, state records show. Illinois paid the Medicaid providers for those additional clients.

A federal emergency measure barred states from striking Medicaid recipients from the rolls, even if those patients weren’t getting care or simply couldn’t be found.

At the same time, many Illinois Medicaid recipients deferred elective medical procedures during the pandemic, according to records and interviews with industry experts.

And at the pandemic’s outset, Illinois pushed out $100 million in payments that are usually withheld until the companies meet performance measures. The aim was to ensure the firms got through an unprecedented and unpredictable period when losses or gains might be staggering.

Eagleson said her effort to financially support Illinois’ insurance providers was shaped in part by her experience wrangling yearslong Illinois budget shortfalls that forced social service contractors to cut services or borrow to function.

“We have to have financially viable plans. When the state can’t pay its bills, they pay providers anyway,” she said.

Ben Winick, Eagleson’s chief of staff, said only financially healthy Medicaid contractors can properly care for their clients.

“We do not want to see our plans making excessive profits,” Winick said. “But it’s also not set up for them to be losing money, either. They need to make money to be financially viable and be adequate partners.”

Kira Leadholm, a graduate student at Northwestern University’s Medill School of Journalism, Media, Integrated Marketing Communications, contributed to this report as a research assistant.

This story was produced by the Better Government Association, a nonprofit news organization based in Chicago.

Local News

Mayor reads hate mail before diving into COVID and crime issues

Spread the loveBy Jeff Vorva Before Tuesday’s village board meeting, Orland Park Mayor Keith Pekau said he received a disturbing email. The mayor, who shoots from the hip when it comes to his beliefs is a controversial public figure and figures to get hate mail. This one was especially nasty. “I figured that since I…

Boys Basketball: Evergreen Park riding out toughest stretch of schedule

Spread the loveBy Jeff Vorva Staff Writer So, how did Evergreen Park get to 9-6 over in its first 15 games? The Mustangs took a rollercoaster ride. In a nutshell: They started the season with four consecutive wins, lost the next three, won five straight and then dropped three in a row. The latest three-game…

Loving the Archer Heights Library

Spread the loveBy Mary Stanek Your correspondent in Archer Heights and West Elsdon 3808 W. 57th Place • (773) 284-7394 Well, that’s it, folks. The holidays are over. Next up in the market are Valentine’s Day candy, paczki, corned beef, Guinness and Peeps. Easter this year is on April 17. I will have to mention…

New year, old challenges

Spread the loveBy Peggy Zabicki Your correspondent in West Lawn 3633 W. 60th Place • (773) 504-9327 It’s a new year and a time for new beginnings. Many of us will be starting a new diet program. I plan to do this as soon as I’m done eating the remaining Christmas candy and cookies at my house. Wish me luck!…

Two ladies gone, but not forgotten

Spread the loveBy Kathy Headley Your correspondent in Chicago Lawn and Marquette Manor 6610 S. Francisco • (773) 776-7778 Guessing you have already read the sad news about the passing of Mary Ellen St. Aubin. For those of you that didn’t know, she grew up right here in Chicago Lawn, on 63rd and Richmond, and…

Stepson charged in Evergreen Park murder

Spread the loveBy Bob Bong A 24-year-old Chicago man has been charged with first-degree murder in the New Year’s Eve shooting of his stepfather in Evergreen Park. Brandon K. Kizer, 24, of the 8100 block of South Loomis in Chicago, was charged Sunday with first-degree murder in the death of Anthony Young, 52, on the…

Honored for service to business

Spread the loveFabis earns UBAM award By Dermot Connolly The United Business Association of Midway recently honored founding member Mary Fabis with a Lifetime Membership Award for Outstanding Service for her 35 years of work with the business organization she continues to serve as a board member. Fabis, now 92, has owned and operated Archer…

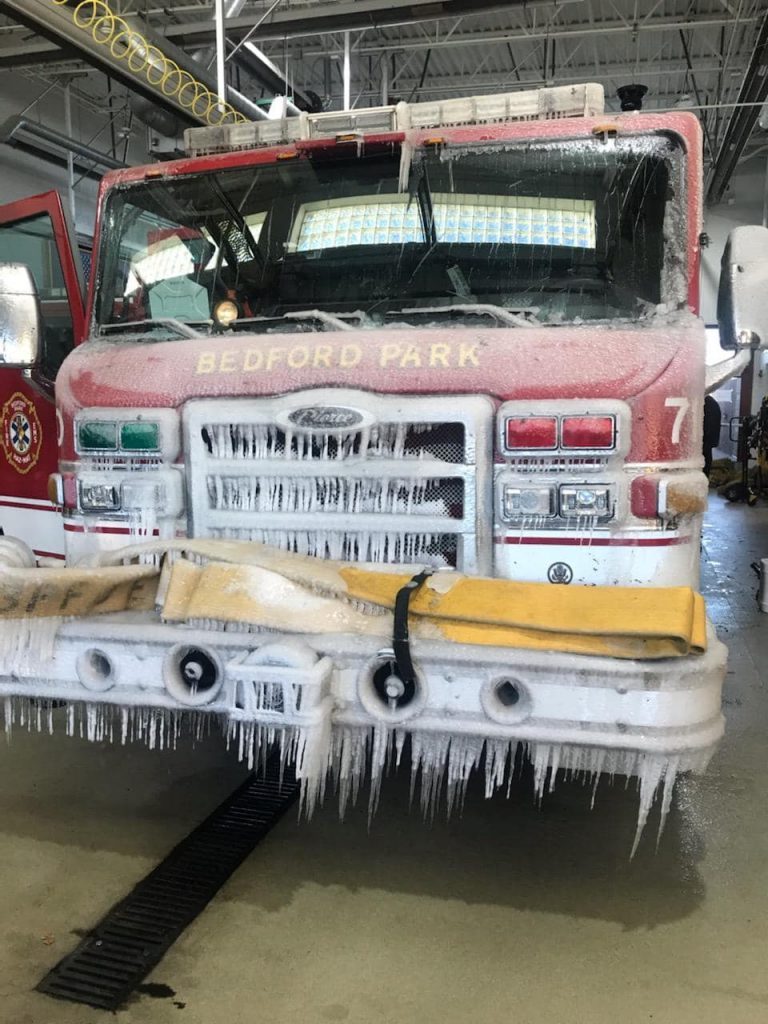

Fire and ice

Spread the love December was unseasonably dry and warm, but it was cold enough late in the month to form icicles on a Bedford Park Fire Department truck– even after it returned from a blaze that gutted a warehouse in the 6500 block of South Lavergne, just steps south of Clearing. The weather forecast for…

Neighbors

Township of Lyons donates $10,000 to help food pantries

Spread the loveBy Steve Metsch The Township of Lyons board was in a giving mood at its most recent meeting. The board approved sponsorships and donations totaling $12,250. The largest donation was $10,000. It went to the Greater Chicago Food Depository which runs 12 monthly mobile food pantries in the township each year. Supervisor Christopher…

Countryside zoning commissioner honored for 20 years on board

Spread the loveBy Steve Metsch For the past 20 years, Tina Grotzke has had a say-so in every development that’s come to Countryside. Grotzke was appointed to another term on the city’s the plan commission zoning board of appeals during the city council’s meeting on June 12. Mayor Sean McDermott noted Grotzke’s two decades of…

Nuccio bids farewell to Indian Springs SD 109

Spread the loveBy Carol McGowan After 25 years of serving the area, 22 of those at Indian Springs School District 109, Dr. Blair Nuccio is set to retire. Dr. Nuccio was the assistant superintendent at District 109 before becoming superintendent in July of 2017. Prior to that, he spent three years as the superintendent at…

A real knockout

Spread the loveLyons boy, 10, heads to boxing nationals By Steve Metsch Dario Lemus Jr., has yet to knock out an opponent in the boxing ring. Give him time. After all, the 10-year-old Lyons boy has only been boxing for 18 months. “I’ve dropped two kids, but not like a knockout,” Dario said with a…

New Middle Eastern coffee shop opens next to Bridgeview courthouse

Spread the loveBy Nuha Abdessalam Coffee connoisseurs take heart, Bridgeview Court Plaza’s newest addition, The Qahwa, is now open. Prepare to be captivated by a truly unique Middle Eastern coffee experience, nestled in the heart of Bridgeview’s “Little Palestine.” The Qahwa, with its one-of-a-kind Middle Eastern coffee blends and inviting atmosphere, is a haven for…

Temps were hot, but golfers were cool

Spread the love. Kathy Headley Your correspondent in Chicago Lawn and Marquette Manor 6610 S. Francisco • (773) 776-7778 . The weekend of June 22/23 started with temps in the 90s, a high humidity both days and the threat of rain loomed throughout the weekend as well. This is not unusual for the third week…

Oak Lawn Fourth of July festivities

Spread the loveCelebrate Independence Day at the Village of Oak Lawn’s annual Fourth of July Parade at 4 p.m. on Saturday, June 29! This cherished community event brings together families, friends, and neighbors to honor the spirit of freedom and patriotism. Parade will step off at 95th Street and Lacrosse and head west on 95th…

District 230 names Director of Safety and Security

Spread the loveFrom staff reports The Consolidated High School District 230 Board of Education approved Dr. Mary Pat Carr as the district’s first Director of Security. She will move from her current position as Assistant Principal of Activities at Stagg High School to the Administrative Center on July 1. Her duties as Director of Safety…

Worth Public Library kicks off summer reading program

Spread the loveBy Kelly White Patrons at the Worth Public Library welcomed in the summer season earlier this month. The library, 6917 W. 111th St., hosted its annual celebration on June 1 to bring patrons of all ages out to sign up for its summer reading program. “We love any excuse to celebrate reading with…

Fire knocks out Orland’s UFC Gym

Spread the loveFrom staff reports A fire last Thursday afternoon practically destroyed an Orland Park gym and knocked out neighboring businesses, as well. Orland Park firefighters received a call at 2:31 p.m. June 20 for a reported fire in the UFC Gym located at 66 Orland Square Drive Unit C. Multiple 911 calls were received for a…