Unprecedented unemployment deficit threatens to ‘cripple’ businesses, claimants

By JERRY NOWICKI

Capitol News Illinois

jnowicki@capitolnewsillinois.com

SPRINGFIELD – Since economic shutdowns began and COVID-19 death counts started to rise in March 2020, national unemployment rates have hovered at historically high numbers, stressing state unemployment systems left dealing with an unprecedented number of claims.

In Illinois, that’s led to a deficit in the Unemployment Insurance Trust Fund – or the pool of money used to sustain the social safety net – that could rise to $5 billion.

Stakeholders from both political parties, as well as business and labor groups, are now warning of “crippling” tax increases on businesses and cuts to unemployment benefits that could result if the ongoing deficit goes unaddressed for too long.

But even as the deficit continues to grow amid still-high unemployment rates, state lawmakers have not set a clear path forward for digging out of the historic hole.

“I think a larger discussion has to begin sooner rather than later, but we’re kind of waiting on, you know, getting a total handle on the size of the problem,” Rep. Jay Hoffman, a Swansea Democrat and assistant majority leader who is a lead House negotiator on unemployment insurance issues, said in a phone interview.

Meanwhile, the state also faces looming interest payments that are likely to cost tens of millions of dollars annually on more than $4 billion of federal borrowing undertaken to pay out benefits at the height of the pandemic.

Lawmakers and stakeholders reached by Capitol News Illinois said they were hopeful for another round of federal aid, this time targeted to shore up trust funds nationwide. Failing that, members of both parties believe the state should use a large portion of its remaining federal American Rescue Plan Act funds – a sum of more than $5 billion of the $8.1 billion allocated to the state – to address the deficit.

The Trust Fund

Each state has an Unemployment Insurance Trust Fund account maintained by the U.S. Treasury but funded by the state’s businesses through insurance premiums collected via payroll taxes. The rates at which businesses pay into Illinois’ fund are determined by a complex statutory formula, based on unemployment rates, the solvency of the Trust Fund, employer experience, number of employees and other factors.

Normally, the incoming funds outpace the amount of outgoing unemployment benefits, but as the state’s unemployment rate grew as high as an unprecedented 16 percent in April 2020 amid forced economic shutdowns, those trends drastically reversed.

When this happens, states can borrow from the federal government in what is called a Title XII advance to pay unemployment claims. As of July 7, Illinois’ outstanding balance for federal Title XII borrowing was $4.2 billion, according to the U.S Treasury, but that number is expected to grow this year as the unemployment rate remains high, most recently measuring at 7.1 percent in May 2021.

By the end of 2021, according to the Illinois Department of Employment Security, the deficit is expected to grow to somewhere between $4.37 billion in an expected trajectory to $4.97 billion in a pessimistic scenario. At its current pace, the department projects the deficit would continue to grow into 2022, increasing to somewhere between $4.4 billion and $5.29 billion before it begins to slowly taper off.

As of July 7, Illinois was one of 17 states with a trust fund deficit, and the collective national deficit exceeded $54 billion. California had the largest hole at more than $22 billion, followed by New York at more than $9.8 billion, Texas at $6.9 billion, Massachusetts at more than $2.2 billion, four states over $1 billion and the rest below that amount.

While federal lawmakers passed a moratorium on Title XII interest payments in previous COVID-19 relief packages, it is scheduled to expire on Sept. 6, at which point interest will begin to accrue at a rate of 2.27 percent. According to IDES, the state has allocated $10 million for interest payments in the current fiscal year, the first of which will be due Sept. 30.

Business groups have projected the interest payment could be as high as $14 million for the four-month period in 2021 after the moratorium ends, and about $50-60 million annually thereafter while the deficit remains.

Addressing the deficit

When deficits reach such a mass, options for paring them down include an increase to the tax rate for employers, a reduction in unemployment benefits, an addition of other state, federal or private sector funds, or some combination of those efforts.

If any state maintains an outstanding balance of federal borrowing for too long, federal law stipulates that Federal Unemployment Tax Act credits for businesses would decrease incrementally, eventually increasing an employer’s tax burden from about 0.6 percent to 6 percent. But no states are in danger of a reduction to that credit in 2021.

Illinois law, however, builds “speed bumps” into the repayment process which encourage labor and business interests to come to the negotiating table to address deficits in a timely manner. Those “speed bumps” initiate penalties that, beginning in 2022, would include shortening the benefit period from 26 to 24 weeks, lowering wage repayment for claimants from 47 percent to 42.4 percent, and an increase to the formulaic employer tax rates, according to IDES.

Rob Karr, CEO and president of the Illinois Retail Merchants Association, estimated that the “speed bumps” would essentially raise taxes by $500 million on employers and cut $500 million in unemployment benefits.

Karr said IRMA joined other business and labor organizations in submitting a letter to Illinois’ congressional delegation to encourage further federal aid, but there’s no timeline yet as to when, or if, such aid would be coming.

But the simplest solution to avoid those penalties, Karr said, is to dedicate a large portion of the state’s remaining $5-plus billion in American Rescue Plan Act funding – a measure signed into law by President Joe Biden earlier this year to stimulate state economies amid the pandemic’s toll – to paying down the deficit.

“Other states have used ARPA money to restore the trust fund to protect workers and employers, and if the state doesn’t do it, employers are going to have crippling taxes and employees are going to have crippling benefit cuts,” Karr said.

State Sen. Chapin Rose, a Mahomet Republican who spoke against this fiscal year’s budget at the end of May due in large part to its failure to address the Trust Fund deficit, warned of drastic economic repercussions if the “speed bumps” take effect.

“If you’re a restaurant trying to reopen after COVID and you’ve been closed, and you’re just now getting your feet back under you and suddenly you get hit with this smack-down penalty, well, you know, that’s less employees you can rehire, it’s less new employees that you could hire, or maybe you just don’t reopen at all,” he said. “Or that cost gets passed along to the consumer.”

Labor interests will be in on negotiations to address the deficit as well. Pat Devaney, secretary treasurer at the Illinois AFL-CIO federation of labor unions, said unions will work to limit the burden on those claiming benefits, but he also noted some other form of state or federal funding would be needed to shore up the Trust Fund.

“I think everybody agrees, whether you’re on the employer side or the employee side, that given the current deficit, it’s going to be near impossible to cut your way or to raise employer taxes to resolve the existing level of deficit,” he said.

Past, potential solutions

In the current fiscal year budget, which took effect July 1, lawmakers dedicated just $100 million to the Trust Fund, but that will go mostly to allowing non-instructional education employees to claim benefits and ensuring that Illinoisans who were paid extra unemployment funds through no fault of their own would not be forced to repay them.

While Republicans voted unanimously in favor of the measure implementing that provision, they also argued that the General Assembly should have already been developing a plan for dedicating ARPA funds to the deficit.

Hoffman said “every single possible solution has to be on the table” for addressing the deficit when lawmakers begin negotiations, including using ARPA funds, reducing benefits, raising employer taxes or some combination of all three.

The closest precedent the state has for addressing such a deficit comes from its effort to dig out of a $2.3 billion hole from 2010 which followed the nationwide financial crisis which began in 2007.

Karr was part of the negotiations to address the deficit stemming from that crisis.

The solution at that time included benefit cuts and raised premium rates for employers, but lawmakers also dedicated a portion of those premiums as a revenue stream to pay back 10-year bonds, which they used to replenish the Trust Fund. Those bonds were paid back in about 7.5 years, Karr said, and the Trust Fund was back above water by 2012, according to IDES.

“But this time, you’ve got such a big problem that that’s not going to be feasible,” Karr said.

Gov. JB Pritzker’s office did not directly respond to questions as to whether ARPA funds might be put toward the deficit. Instead, a spokesperson issued a statement saying the governor is seeking further federal aid as well.

“The COVID-19 global pandemic has left every state in the nation facing unemployment trust fund shortfalls,” the spokesperson said. “As the state works to emerge from this pandemic with continued economic growth, the administration has been in communication with our federal partners to ensure there is a comprehensive solution that provides support for working families and balances that vital need with consideration for the business community.”

In a news conference in Springfield on Thursday, Illinois’ U.S. Sen. Dick Durbin, a Democrat, said “there’s been a conversation” in Washington, D.C., about addressing state trust fund deficits. He expects unemployment discussions to progress starting in September, when federal unemployment boosts expire.

Durbin also noted that the federal ARPA funds should provide Illinois some budget leeway, but when asked if he would advise the governor to save some of the remaining funding to pay down the Trust Fund deficit, he did not directly answer.

“I was with him (Pritzker) yesterday, and I asked him if they had any definite plans for the $8 billion. Not yet,” Durbin said. “They’re working with the legislature on that. So in terms of the Unemployment Trust Fund, it didn’t come up in the conversation.”

Rose and other Republicans have argued for ending an extra $300 monthly payment to those on unemployment earlier than the federal expiration set for September. They argue that the money – even though it is fully funded by the federal government – disincentives people from rejoining the workforce by making unemployment benefits more lucrative than taking a lower wage job, thus adding to the state’s burden by keeping people on unemployment.

Democrats, however, have pushed back on that narrative and outright rejected any suggestion of ending the added federal benefits early. Pritzker has focused on the need for affordable child care to allow parents to go back to work.

“We’re trying to measure doing enough to help families and still creating an incentive to get back to work,” Durbin said at his news conference Thursday.

Capitol News Illinois is a nonprofit, nonpartisan news service covering state government and distributed to more than 400 newspapers statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation.

Local News

Cinco de Mayo, here we come

Spread the love. By Mary Stanek Your correspondent in Archer Heights and West Elsdon 3808 W. 57th Place • (773) 517-7796 . It’s time to bring out the Corona, Tecate, Modelo or Dos Equis, along with a few limes. Heck, maybe even bring out the Patrón! It is Cinco de Mayo this Sunday, translated to…

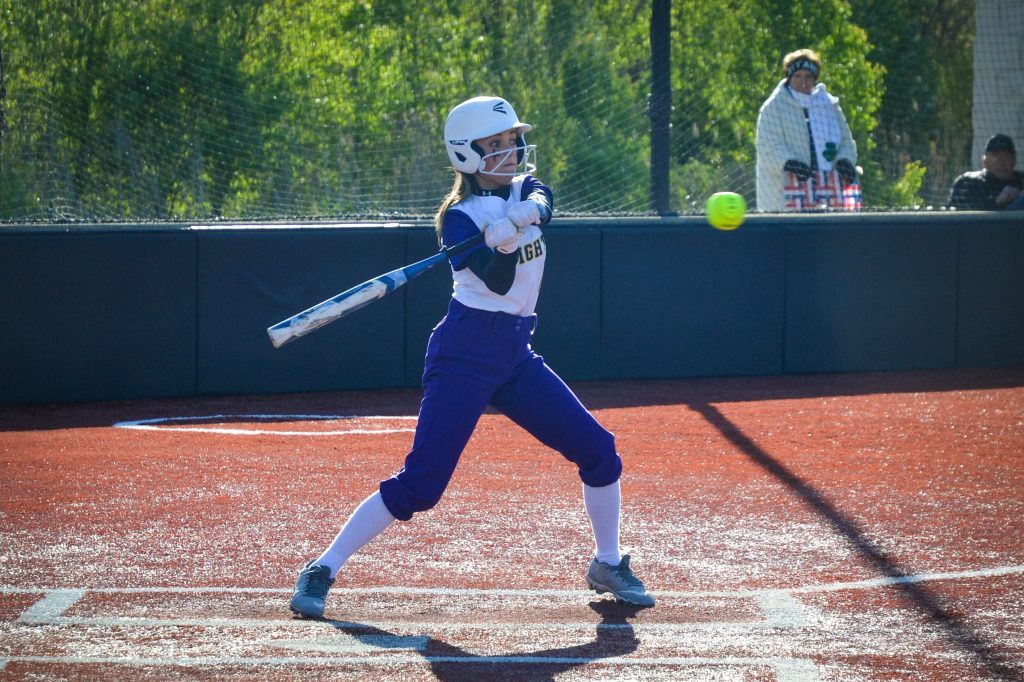

Softball | Jocelyn Hovanec scores two runs, Ks 12 in Chicago Christian win

Spread the loveBy Xavier Sanchez Correspondent Chicago Christian is working to find its footing in the inaugural season of the Chicagoland Christian Conference. The Knights entered this week 6-8 overall and 4-6 in the CCC, putting them in fifth place with just two conference games to play among their final seven regular-season contests. The Knights…

Boys Volleyball | Chicago Christian finishes April strong, takes second at Ridgewood Invitational

Spread the loveBy Xavier Sanchez Correspondent A busy and largely successful final seven days of April saw Chicago Christian briefly climb back to the .500 mark after a tough first month of the season. The Knights (11-12, 4-4 Chicagoland Christian Conference) have won seven of their past 10 matches, all of which were played over…

Work moving forward at Marquette Park

Spread the love. Kathy Headley Your correspondent in Chicago Lawn and Marquette Manor 6610 S. Francisco • (773) 776-7778 . In the March 29 edition of the Greater Southwest News-Herald, I wrote a story about a town hall meeting at Marquette Park, we learned of some of the upcoming plans the Park District has for…

Sophia Smith’s brace sinks Red Stars

Spread the loveBy Jeff Vorva Correspondent Home has not been that sweet lately for the Chicago Red Stars. The team lost its second straight game at SeatGeek Stadium with a 2-0 setback to Portland in front of an announced crowd of 4,443 on April 27. Portland star Sophia Smith scored in the 10th and 26th…

Nazareth Academy celebrates ‘special talent’ J.J. McCarthy in NFL Draft

Spread the loveBy Steve Metsch Dennis Moran has no doubts that J.J. McCarthy – the former Nazareth Academy quarterback who is now with the Minnesota Vikings – will succeed in the National Football League. Moran was among about 60 or so Nazareth Academy fans, friends and coaches who gathered Thursday night at The Stadium Club…

Brother Rice names Al Perez next soccer coach

Spread the loveBy Jeff Vorva Correspondent A few new coaches are dotting the area high school athletic scene. One of the more notable hires was Brother Rice bringing Al Perez aboard as the soccer coach. Perez led Chicago Public League power Washington to a Class 2A state championship in 2013, a fourth-place finish in 2015…

Police Council rallies to save ShotSpotter

Spread the love. By Alexis Bocanegra Your correspondent in Clearing and Garfield Ridge (773) 949-1509 • grcl.alex23@gmail.com . Chicago Lawn (8th) District Police Council members Mark Hamberlin, Al Cacciottolo and Jason Huff have created an online petition to save ShotSpotter. As you may have read in the Clear-Ridge Reporter & NewsHound back in March, Mayor…

Capacity crowd speaks out against Evergreen Park dispensary

Spread the loveBy Joe Boyle Additional chairs had to be brought out to seat an overflow crowd of Evergreen Park residents who attended a meeting April 15 regarding a proposed cannabis dispensary for the village. And many who were in attendance voiced their opposition to having a dispensary in Evergreen Park. Most of the people cited…

Neighbors

Mother’s Day is truly a day to be celebrated

Spread the love. Peggy Zabicki Your correspondent in West Lawn 3633 W. 60th Place • (773) 504-9327 . Mother’s Day happens on Sunday, May 12. If this isn’t something to celebrate, I don’t know what is. Motherhood means new life, new beginnings, new possibilities. Even if you won’t be seeing your mom, you can still…

Saint Xavier men’s volleyball finishes historic season in nation’s top 4

Spread the loveBy Jeff Vorva Correspondent The Saint Xavier men’s volleyball team made history by advancing to the semifinals of the NAIA Men’s Volleyball National Championship. But the Cougars fell to eventual national champion Georgetown (Kentucky), 25-21, 25-23, 22-25, 21-25, 15-10, on May 3 at Alliant Energy PowerHouse in Cedar Rapids, Iowa. Although there was…

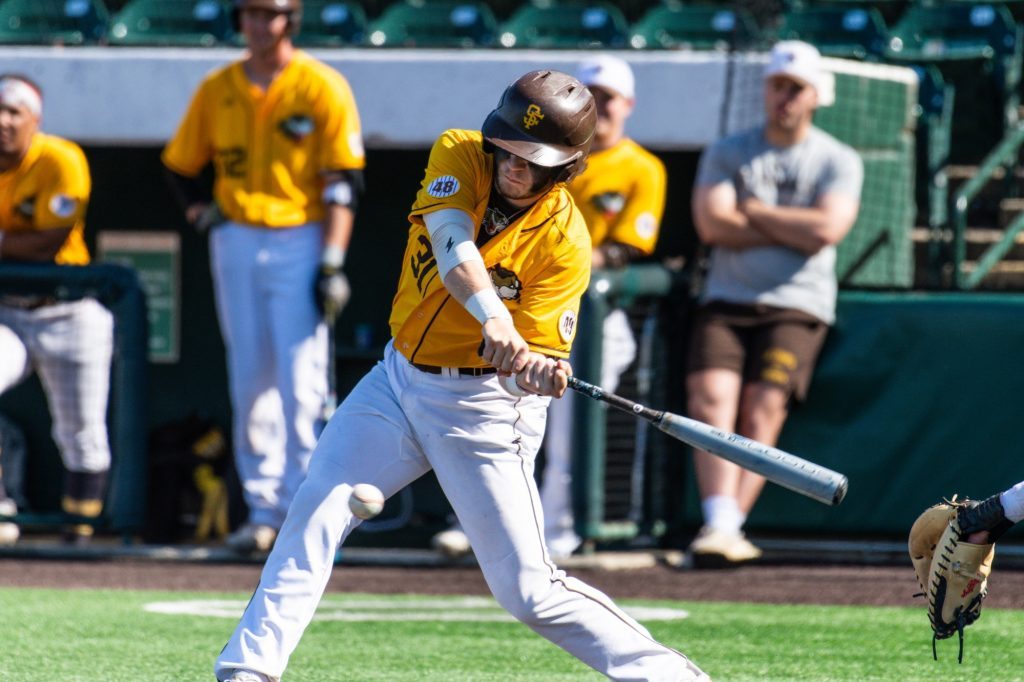

St. Francis first baseman Nate Maliska earns conference POW honors

Spread the loveBy Mike Walsh Correspondent The University of St. Francis sophomore first baseman Nate Maliska was chosen the Chicagoland Collegiate Athletic Conference’s Player of the Week in baseball for April 7. In helping the Saints to four wins that week, Maliska went 9-for-15 (.600) with eight RBI and seven runs scored. The St. Laurence…

Baseball | Marist claws way back to .500

Spread the loveBy Xavier Sanchez Correspondent This season has thus far not been what Marist had expected, but the RedHawks came into this week at .500. Marist was 2-8 after 10 games this season, with three of those first eight losses coming via shutout. But the RedHawks turned things around with a stretch of eight…

Red Stars fall to Spirit for third loss in past four matches

Spread the loveBy Jeff Vorva Correspondent After enjoying one of their best starts in franchise history, the Chicago Red Stars have slid to the middle of the NWSL standings, with the latest setback being a 4-2 loss to Washington at SeatGeek Stadium. The Stars (3-3-1) entered this week having dropped three of their past four…

Red Stars take aim at NWSL attendance record with Wrigley game

Spread the loveBy Jeff Vorva Correspondent The Chicago Red Stars are thinking big when it comes to their upcoming game at Wrigley Field. The team is taking aim at the NWSL record for single-game attendance when it hosts Bay FC at the historic home of the Chicago Cubs on June 8. The record is held…

IHSA announces boys volleyball postseason assignments

Spread the loveBy Jeff Vorva Correspondent Last year, the area sent a pair of boys volleyball teams to state as Lyons finished runner-up to champion Glenbard South and Brother Rice lost in the quarterfinals. This year, both could face each other in the sectional finals. The Lions picked up the second seed and the Crusaders…

Badminton players from Reavis and Lyons going to state

Spread the loveBy Jeff Vorva Correspondent Reavis singles player Dania Amjad finished third in the Bolingbrook Sectional on May 2 to qualify for the IHSA state tournament. The Lyons doubles team of Simone Brown and Mia Graziano finished fourth in the York Sectional to qualify for state. The state finals are May 10-11 at DeKalb…

Brother Rice, Sandburg sending boats to bass fishing state tourney

Spread the loveBy Jeff Vorva Correspondent Brother Rice is sending two boats to the IHSA state bass fishing tournament. The Crusaders had first- and third-place finishes at the Des Plaines River Big Basin Marina Sectional on May 2. Sandwiched in between the Brother Rice boats was a group from Sandburg in second place. The Crusaders’…