Unprecedented unemployment deficit threatens to ‘cripple’ businesses, claimants

By JERRY NOWICKI

Capitol News Illinois

jnowicki@capitolnewsillinois.com

SPRINGFIELD – Since economic shutdowns began and COVID-19 death counts started to rise in March 2020, national unemployment rates have hovered at historically high numbers, stressing state unemployment systems left dealing with an unprecedented number of claims.

In Illinois, that’s led to a deficit in the Unemployment Insurance Trust Fund – or the pool of money used to sustain the social safety net – that could rise to $5 billion.

Stakeholders from both political parties, as well as business and labor groups, are now warning of “crippling” tax increases on businesses and cuts to unemployment benefits that could result if the ongoing deficit goes unaddressed for too long.

But even as the deficit continues to grow amid still-high unemployment rates, state lawmakers have not set a clear path forward for digging out of the historic hole.

“I think a larger discussion has to begin sooner rather than later, but we’re kind of waiting on, you know, getting a total handle on the size of the problem,” Rep. Jay Hoffman, a Swansea Democrat and assistant majority leader who is a lead House negotiator on unemployment insurance issues, said in a phone interview.

Meanwhile, the state also faces looming interest payments that are likely to cost tens of millions of dollars annually on more than $4 billion of federal borrowing undertaken to pay out benefits at the height of the pandemic.

Lawmakers and stakeholders reached by Capitol News Illinois said they were hopeful for another round of federal aid, this time targeted to shore up trust funds nationwide. Failing that, members of both parties believe the state should use a large portion of its remaining federal American Rescue Plan Act funds – a sum of more than $5 billion of the $8.1 billion allocated to the state – to address the deficit.

The Trust Fund

Each state has an Unemployment Insurance Trust Fund account maintained by the U.S. Treasury but funded by the state’s businesses through insurance premiums collected via payroll taxes. The rates at which businesses pay into Illinois’ fund are determined by a complex statutory formula, based on unemployment rates, the solvency of the Trust Fund, employer experience, number of employees and other factors.

Normally, the incoming funds outpace the amount of outgoing unemployment benefits, but as the state’s unemployment rate grew as high as an unprecedented 16 percent in April 2020 amid forced economic shutdowns, those trends drastically reversed.

When this happens, states can borrow from the federal government in what is called a Title XII advance to pay unemployment claims. As of July 7, Illinois’ outstanding balance for federal Title XII borrowing was $4.2 billion, according to the U.S Treasury, but that number is expected to grow this year as the unemployment rate remains high, most recently measuring at 7.1 percent in May 2021.

By the end of 2021, according to the Illinois Department of Employment Security, the deficit is expected to grow to somewhere between $4.37 billion in an expected trajectory to $4.97 billion in a pessimistic scenario. At its current pace, the department projects the deficit would continue to grow into 2022, increasing to somewhere between $4.4 billion and $5.29 billion before it begins to slowly taper off.

As of July 7, Illinois was one of 17 states with a trust fund deficit, and the collective national deficit exceeded $54 billion. California had the largest hole at more than $22 billion, followed by New York at more than $9.8 billion, Texas at $6.9 billion, Massachusetts at more than $2.2 billion, four states over $1 billion and the rest below that amount.

While federal lawmakers passed a moratorium on Title XII interest payments in previous COVID-19 relief packages, it is scheduled to expire on Sept. 6, at which point interest will begin to accrue at a rate of 2.27 percent. According to IDES, the state has allocated $10 million for interest payments in the current fiscal year, the first of which will be due Sept. 30.

Business groups have projected the interest payment could be as high as $14 million for the four-month period in 2021 after the moratorium ends, and about $50-60 million annually thereafter while the deficit remains.

Addressing the deficit

When deficits reach such a mass, options for paring them down include an increase to the tax rate for employers, a reduction in unemployment benefits, an addition of other state, federal or private sector funds, or some combination of those efforts.

If any state maintains an outstanding balance of federal borrowing for too long, federal law stipulates that Federal Unemployment Tax Act credits for businesses would decrease incrementally, eventually increasing an employer’s tax burden from about 0.6 percent to 6 percent. But no states are in danger of a reduction to that credit in 2021.

Illinois law, however, builds “speed bumps” into the repayment process which encourage labor and business interests to come to the negotiating table to address deficits in a timely manner. Those “speed bumps” initiate penalties that, beginning in 2022, would include shortening the benefit period from 26 to 24 weeks, lowering wage repayment for claimants from 47 percent to 42.4 percent, and an increase to the formulaic employer tax rates, according to IDES.

Rob Karr, CEO and president of the Illinois Retail Merchants Association, estimated that the “speed bumps” would essentially raise taxes by $500 million on employers and cut $500 million in unemployment benefits.

Karr said IRMA joined other business and labor organizations in submitting a letter to Illinois’ congressional delegation to encourage further federal aid, but there’s no timeline yet as to when, or if, such aid would be coming.

But the simplest solution to avoid those penalties, Karr said, is to dedicate a large portion of the state’s remaining $5-plus billion in American Rescue Plan Act funding – a measure signed into law by President Joe Biden earlier this year to stimulate state economies amid the pandemic’s toll – to paying down the deficit.

“Other states have used ARPA money to restore the trust fund to protect workers and employers, and if the state doesn’t do it, employers are going to have crippling taxes and employees are going to have crippling benefit cuts,” Karr said.

State Sen. Chapin Rose, a Mahomet Republican who spoke against this fiscal year’s budget at the end of May due in large part to its failure to address the Trust Fund deficit, warned of drastic economic repercussions if the “speed bumps” take effect.

“If you’re a restaurant trying to reopen after COVID and you’ve been closed, and you’re just now getting your feet back under you and suddenly you get hit with this smack-down penalty, well, you know, that’s less employees you can rehire, it’s less new employees that you could hire, or maybe you just don’t reopen at all,” he said. “Or that cost gets passed along to the consumer.”

Labor interests will be in on negotiations to address the deficit as well. Pat Devaney, secretary treasurer at the Illinois AFL-CIO federation of labor unions, said unions will work to limit the burden on those claiming benefits, but he also noted some other form of state or federal funding would be needed to shore up the Trust Fund.

“I think everybody agrees, whether you’re on the employer side or the employee side, that given the current deficit, it’s going to be near impossible to cut your way or to raise employer taxes to resolve the existing level of deficit,” he said.

Past, potential solutions

In the current fiscal year budget, which took effect July 1, lawmakers dedicated just $100 million to the Trust Fund, but that will go mostly to allowing non-instructional education employees to claim benefits and ensuring that Illinoisans who were paid extra unemployment funds through no fault of their own would not be forced to repay them.

While Republicans voted unanimously in favor of the measure implementing that provision, they also argued that the General Assembly should have already been developing a plan for dedicating ARPA funds to the deficit.

Hoffman said “every single possible solution has to be on the table” for addressing the deficit when lawmakers begin negotiations, including using ARPA funds, reducing benefits, raising employer taxes or some combination of all three.

The closest precedent the state has for addressing such a deficit comes from its effort to dig out of a $2.3 billion hole from 2010 which followed the nationwide financial crisis which began in 2007.

Karr was part of the negotiations to address the deficit stemming from that crisis.

The solution at that time included benefit cuts and raised premium rates for employers, but lawmakers also dedicated a portion of those premiums as a revenue stream to pay back 10-year bonds, which they used to replenish the Trust Fund. Those bonds were paid back in about 7.5 years, Karr said, and the Trust Fund was back above water by 2012, according to IDES.

“But this time, you’ve got such a big problem that that’s not going to be feasible,” Karr said.

Gov. JB Pritzker’s office did not directly respond to questions as to whether ARPA funds might be put toward the deficit. Instead, a spokesperson issued a statement saying the governor is seeking further federal aid as well.

“The COVID-19 global pandemic has left every state in the nation facing unemployment trust fund shortfalls,” the spokesperson said. “As the state works to emerge from this pandemic with continued economic growth, the administration has been in communication with our federal partners to ensure there is a comprehensive solution that provides support for working families and balances that vital need with consideration for the business community.”

In a news conference in Springfield on Thursday, Illinois’ U.S. Sen. Dick Durbin, a Democrat, said “there’s been a conversation” in Washington, D.C., about addressing state trust fund deficits. He expects unemployment discussions to progress starting in September, when federal unemployment boosts expire.

Durbin also noted that the federal ARPA funds should provide Illinois some budget leeway, but when asked if he would advise the governor to save some of the remaining funding to pay down the Trust Fund deficit, he did not directly answer.

“I was with him (Pritzker) yesterday, and I asked him if they had any definite plans for the $8 billion. Not yet,” Durbin said. “They’re working with the legislature on that. So in terms of the Unemployment Trust Fund, it didn’t come up in the conversation.”

Rose and other Republicans have argued for ending an extra $300 monthly payment to those on unemployment earlier than the federal expiration set for September. They argue that the money – even though it is fully funded by the federal government – disincentives people from rejoining the workforce by making unemployment benefits more lucrative than taking a lower wage job, thus adding to the state’s burden by keeping people on unemployment.

Democrats, however, have pushed back on that narrative and outright rejected any suggestion of ending the added federal benefits early. Pritzker has focused on the need for affordable child care to allow parents to go back to work.

“We’re trying to measure doing enough to help families and still creating an incentive to get back to work,” Durbin said at his news conference Thursday.

Capitol News Illinois is a nonprofit, nonpartisan news service covering state government and distributed to more than 400 newspapers statewide. It is funded primarily by the Illinois Press Foundation and the Robert R. McCormick Foundation.

Local News

Man charged with child abduction in Stickney Township

Spread the loveFrom staff reports A Chicago man was charged last week with child abduction and luring of a minor after Cook County Sheriff’s Police detectives found he attempted to lure a minor into his vehicle, said Cook County Sheriff Thomas J. Dart. According to police, about 4:43 p.m. on Monday, April 22, officers responded…

Worth Library celebrates 60th anniversary

Spread the loveBy Kelly White The Worth Public Library has been around for decades. Resting in the heart of the village at 6917 W. 111th St., the library held an event focusing on its rich background story on April 23 with a historical photo exhibit. “It’s amazing because this library is still so important to…

Rose Zubik, Woman’s Club veteran, installed as 3rd District president

Spread the love Rose Zubik, of Palos Heights, the new president of the 3rd District General Federation of Women’s Clubs-Illinois, lights a candle during the installation ceremony held April 27 at Fox’s Restaurant in Orland Park. Heather Linehan, the outgoing president, is beside her.By Dermot Connolly A longtime member of the Palos Heights Woman’s Club…

Shots fired in Chicago Ridge Commons parking lot

Spread the loveFrom staff reports Shots were fired Wednesday night in the parking lot at Chicago Ridge Commons mall. Police said they received reports of the shooting about 9:45 p.m. No injuries were reported. Multiple witnesses told police four men were walking through the parking lot from the XSport Fitness area. They approached two vehicles…

Hair salon with a ‘flair’ marks first year in Chicago Ridge

Spread the loveBy Joe Boyle Melissa Kowalski wanted to do something meaningful to mark the first-year anniversary of her Flair With Hair Salon in Chicago Ridge. “We did not have a grand opening last year so I wanted to do something really special,” Kowalski said. “We wanted to say thank you to our clients.” Kowalski,…

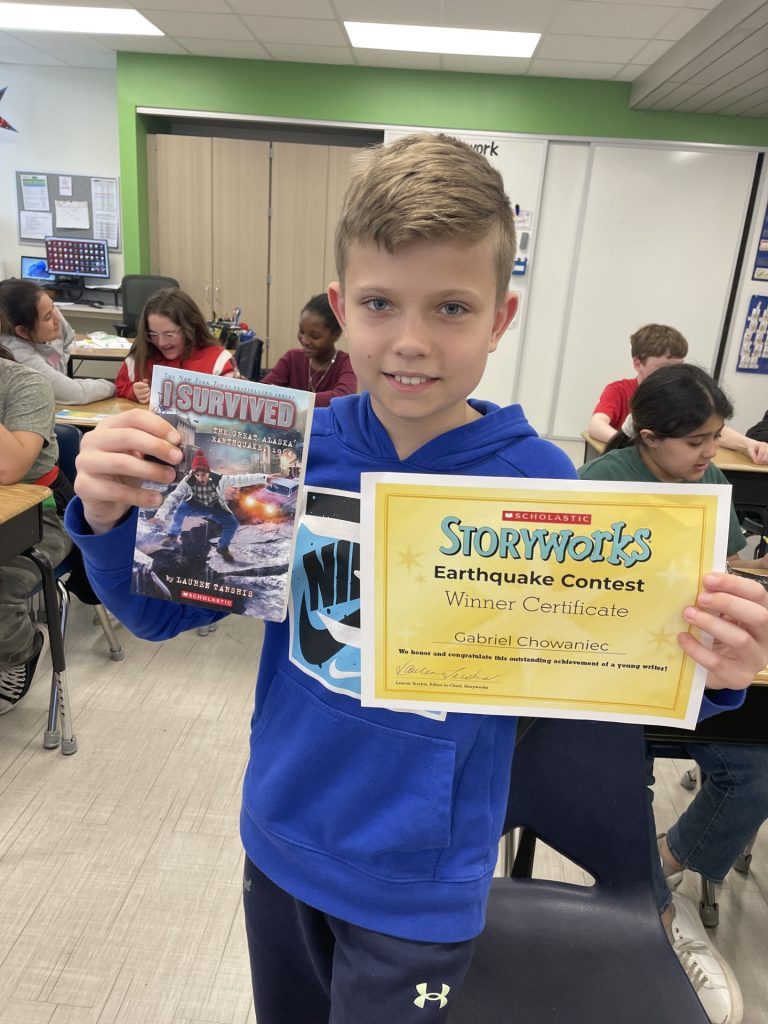

Palos East fifth-grader wins Scholastic Storyworks writing contest

Spread the loveGabriel Chowaniec, a fifth-grader at Palos East Elementary School, has been named a winner of the Scholastic Storyworks Magazine writing contest. Gabriel, who is a student in Cathy Casey’s fifth-grade classroom, was named one of only five winners nationally for the December 2023/January 2024 competition. Garbriel’s submission for the nonfiction story “The Shattered Land,” “showed a strong understanding of the text along with the ability to author a well-organized…

Shepard celebrates Autism Week

Spread the loveBy Kelly White World Autism Acceptance Week is organized by the National Autistic Society in the first week of April and aims to raise awareness about the challenges autistic people face across all areas of society. Not missing out the opportunity to celebrate all-inclusion was Shepard High School, 13049 S. Ridgeland Ave., Palos…

Billions of cicadas get ready to raise a racket

Spread the loveBy Kelly White If you haven’t heard the buzz yet, you will soon. With 2024 marking a big year for periodical cicadas in Illinois, billions of the red-eyed buggers will soon be making an appearance. Periodical cicada broods XIII and XIX will be emerging throughout much of the state at the same time.…

‘A man of honor, a beacon of kindness’

Spread the love. Chicago weeps for Officer Luis Huesca . By Tim Hadac People across the Southwest Side shed tears earlier this week, as throngs of police officers and other filled the St. Rita of Cascia Shrine Chapel at 77th and Western for a funeral Mass for CPD Officer Luis M. Huesca. Officer Huesca was…

Neighbors

Man charged with child abduction in Stickney Township

Spread the loveFrom staff reports A Chicago man was charged last week with child abduction and luring of a minor after Cook County Sheriff’s Police detectives found he attempted to lure a minor into his vehicle, said Cook County Sheriff Thomas J. Dart. According to police, about 4:43 p.m. on Monday, April 22, officers responded…

Worth Library celebrates 60th anniversary

Spread the loveBy Kelly White The Worth Public Library has been around for decades. Resting in the heart of the village at 6917 W. 111th St., the library held an event focusing on its rich background story on April 23 with a historical photo exhibit. “It’s amazing because this library is still so important to…

Rose Zubik, Woman’s Club veteran, installed as 3rd District president

Spread the love Rose Zubik, of Palos Heights, the new president of the 3rd District General Federation of Women’s Clubs-Illinois, lights a candle during the installation ceremony held April 27 at Fox’s Restaurant in Orland Park. Heather Linehan, the outgoing president, is beside her.By Dermot Connolly A longtime member of the Palos Heights Woman’s Club…

Shots fired in Chicago Ridge Commons parking lot

Spread the loveFrom staff reports Shots were fired Wednesday night in the parking lot at Chicago Ridge Commons mall. Police said they received reports of the shooting about 9:45 p.m. No injuries were reported. Multiple witnesses told police four men were walking through the parking lot from the XSport Fitness area. They approached two vehicles…

Hair salon with a ‘flair’ marks first year in Chicago Ridge

Spread the loveBy Joe Boyle Melissa Kowalski wanted to do something meaningful to mark the first-year anniversary of her Flair With Hair Salon in Chicago Ridge. “We did not have a grand opening last year so I wanted to do something really special,” Kowalski said. “We wanted to say thank you to our clients.” Kowalski,…

Palos East fifth-grader wins Scholastic Storyworks writing contest

Spread the loveGabriel Chowaniec, a fifth-grader at Palos East Elementary School, has been named a winner of the Scholastic Storyworks Magazine writing contest. Gabriel, who is a student in Cathy Casey’s fifth-grade classroom, was named one of only five winners nationally for the December 2023/January 2024 competition. Garbriel’s submission for the nonfiction story “The Shattered Land,” “showed a strong understanding of the text along with the ability to author a well-organized…

Shepard celebrates Autism Week

Spread the loveBy Kelly White World Autism Acceptance Week is organized by the National Autistic Society in the first week of April and aims to raise awareness about the challenges autistic people face across all areas of society. Not missing out the opportunity to celebrate all-inclusion was Shepard High School, 13049 S. Ridgeland Ave., Palos…

Billions of cicadas get ready to raise a racket

Spread the loveBy Kelly White If you haven’t heard the buzz yet, you will soon. With 2024 marking a big year for periodical cicadas in Illinois, billions of the red-eyed buggers will soon be making an appearance. Periodical cicada broods XIII and XIX will be emerging throughout much of the state at the same time.…

‘A man of honor, a beacon of kindness’

Spread the love. Chicago weeps for Officer Luis Huesca . By Tim Hadac People across the Southwest Side shed tears earlier this week, as throngs of police officers and other filled the St. Rita of Cascia Shrine Chapel at 77th and Western for a funeral Mass for CPD Officer Luis M. Huesca. Officer Huesca was…