Tammy Petrovich and her husband stand in front of their burned out home in Countryside (Photo by Carol McGowan)

Assessor promises to fix errors for Lyons Township taxpayers

By Carol McGowan

After lengthy delays, some lasting years, some property owners in Lyons Township are finally getting help from the Cook County Assessor’s Office in fixing faulty property tax bills.

Property owners that the Desplaines Valley News had been in touch with were just looking for fairness in what they were supposed to be paying in property taxes.

Taxpayers in Willow Springs, Countryside, and Summit, to name just a few, said they were being taxed unfairly, and were unable to get relief or even answers from the Cook County Assessor’s Office.

Their complaints were real, according to Lyons Township Assessor Patrick Hynes.

Steve Slas sits on the porch of his home in Willow Springs.

According to Hynes, the Cook County property tax system relies on an accurate physical description of each parcel subject to ad valorem taxation. What improvements are on each parcel? Is it an office high rise, industrial building, auto repair shop, single-family home? The only person tasked with maintaining and keeping these descriptions is Cook County Assessor Fritz Kaegi.

Part of the problem is that there are several layers to the Cook County property tax system. There’s the township assessor, Cook County Assessor, Cook County Board of Review, PTAB, Cook County Clerk, and Cook County Treasurer, said Hynes.

“If each agency kept their own books and their own property descriptions, there would be chaos in the system. So, one and only one is tasked with that job, Cook County Assessor Fritz Kaegi. The others are not empowered to correct erroneous property descriptions,” Hynes said.

“Discover, list and value are the three primary functions of the Cook County Assessor’s office,” Hynes said. “That’s property tax 101 when you start working toward certifications in this field. Discover: Identify there’s a building on a parcel. List: Describe the characteristics of that building for mass appraisal, create a property record card, and add these features to the public record. Value: Generate an estimate of the most probable market value. We’re having problems with the first two functions.”

Hynes said an audit of the Cook County Assessor’s office, conducted by the International Association of Assessing Officers, determined the office was woefully understaffed to maintain property records.

“They recommended the office employ 56 residential field inspectors. Today, the office has 14. As a result, only a portion of new construction in Cook County has been added to the tax rolls the prior three seasons. This problem is countywide, but I’m concerned with cleaning up Lyons Township.”

“When I took office, I started an audit of the property record cards maintained by Assessor Kaegi. I quickly discovered several new construction homes that were completed, occupied for years and never added to the tax rolls. I am 25 percent complete auditing the records. I have discovered $25 million in missing assessments. I estimate $100 million is missing townshipwide, and billions countywide.”

“I have identified these missing assessments and sent them to Assessor Kaegi’s office. They were too busy catching up with the 2021 assessment to add my missing property to the tax rolls. So, I went out and sketched them for him and submitted property record cards. Still, not added to the tax rolls. Very frustrating.”

Hynes told the Desplaines Valley News, “The property records maintained by the County Assessor are not just incomplete, but also rife with errors. Each taxpayer has an opportunity to complain about errors in their property description at appeal season. Every taxpayer who filed an appeal in my township with the Cook County Assessor this season requesting a correction in an erroneous property description was ignored. We did not receive any field checks or property record card updates this year in Lyons during appeal season, as has been office practice the prior three administrations.”

“Assessor Kaegi’s office is the only place these taxpayers can seek relief, because only Assessor Kaegi can change a property description,” he said.

Scott Smith, Chief Communications Officer for the Assessor’s Office, said Kaegi was aware of the problem and has been working to correct the problems.

“The IAAO report, released in 2019, found the office was understaffed for the number of parcels it assesses (1.9 million). The report also noted we had one-quarter of the field staff needed to inspect properties. Moreover, the office had not been using advances in technology to review and update parcels,” Smith wrote in an email.

“Because of this, there has been a backlog of inspections and updates to current properties. Property owners should know that in the past three-and-a-half years, the Assessor’s Office has significantly closed the staffing and technology gaps in our office.

“In 2020, 26% of our new hires were in our valuations department, which handles field inspections and property characteristics updates. In 2021, we built out a new data integrity unit which is tasked with ensuring we have up-to-date information on all properties.

“Since the IAAO audit in 2019, we have implemented 19 of their recommendations and moved forward on technology plans in 4 other recommended areas.”

Hynes highlighted examples of property owners who are being unfairly taxed.

One was Tammy Petrovich, a young mom with young kids.

Her home, at 7000 Golfview Road in Countryside, had a catastrophic fire in April of 2021, rendering it uninhabitable. She filed an appeal with the Cook County Assessor seeking relief, including photos, fire report, and insurance adjuster report. She requested a field check, but no field check had been done and her appeal was denied. There’s been no change in the property record card. She’s being erroneously taxed on a destroyed home.

Work on the house has recently started, but her and her family have not been able to live in the gutted house since the fire as it was completely burned out.

After checking into her case, Smith said, “The value on this property has been corrected for 2021, so it reflects the inhabitability. The property owner’s tax bill will be reduced to reflect that information. The appeal should have been approved in 2021.”

Then there’s a young restauranteur, at 6254 Archer in Summit. His name is Adrian Valladolid. He has an erroneous description on his property record, resulting in $30,000 in excess taxation.

Valladolid lives in the apartment above his restaurant and is being charged commercial rates when he qualifies for class 2-12 at residential rates. A change would require a field inspection, yet after repeatedly requesting a field inspection for three years, he was told he could not get one.

Valladolid says it’s hard to stay afloat because of the money he needs for taxes that he shouldn’t even be paying.

“I’m struggling and still recovering because of COVID. I’m trying to keep my doors open. As everyone knows, it’s hard to find people to work. I interview them, then many want so much more money than I can do right now. If I wasn’t paying more in taxes than I should, I would have that much more to pay employees and put into my business. It’s rough.”

“Apartment units appear to have been placed on top of the restaurant in 2016-2017,” Smith said. “Our records do not currently have apartments on the PIN so we inspected the property this week and we will revisit the classification decision.” He did add that 2-12s must measure less than 20,000 square feet.

Another taxpayer, Vida Rivoli, 4252 Joliet Road in Lyons, had been trying to get answers for three years.

Rivoli was being charged for a commercial space but owns a residential condo. She filed an appeal requesting a property description change without success.

She purchased a residential condo listed on the MLS as such and had no idea what was waiting for her. She has appealed annually, petitioned her condo board for a declaration that no commercial use is allowed in her building. She fought for a special session at the Village of Lyons to rezone the parcel residential use only. Nothing has worked.

Smith had good news for her. “After reviewing the property, there is adequate documentation to warrant a class change from 5-99 to 2-99. The residential department has corrected the classification for 2022, issued a recommendation to the Board of Review for 2021, and issued a Certificate of Error for 2018, 2019, and 2020. A property tax refund will then be issued.”

Then there is Steve Slas, 115 Willow Springs Road, Willow Springs.

Slas has an older two-flat assessed as an industrial building. He appealed and requested a field check. No field check had been performed. He did receive a letter from the Cook County Assessor claiming there had been a field check. FOIA requests and direct questioning by the township assessor revealed there was no field check conducted. As a result, there has been no change in his property record. He pays $15,485 in excess taxation.

The Desplaines Valley News met with Slas at his property. He had piles of correspondence and box of paperwork that he’s been keeping since trying to get his tax issue resolved. It’s not something new. He’s been dealing with this and paying way more than he should since 2008.

Slas may be on the verge of losing his property because of a paperwork error, and he can’t get a simple field check that would help him keep it.

After years of overpaying, it’s hard for him to keep doing it.

Hynes contacted the Cook County Assessor’s Office, and was told there was a desk review in lieu of a physical field check.

That’s it, no further explanation, and Slas is still waiting for the correction to be made.

Slas told the DVN: “I have spent thousands of dollars and hundreds of hours along with the Lyons Township Assessor Patrick Hynes, providing the appropriate documentation in an effort to pay my fair share of property taxes since 2008. In our latest 2021 appeal, Mr. Kaegi’s rejection letter states, ‘They have reviewed our documentation, did a field inspection and a market analysis of my home.’ Through the freedom of information act and a friendly call by Mr. Hynes, we found no field inspection took place, the most recent notes on file are pre-2008 and there was no mention of our requested classification change.”

“This one was a little complicated,” Smith said. “This PIN has two separate building improvements that have different classes. The main property PIN has been classified as an industrial building. The residential improvement is classified as a 2-6 unit apartment and has been classified as a 2-11 for the past 10+ years. Additionally, the land has been valued as 50 percent commercial land (500 Class) and 50 percent residential land (200 Class). So, we have been recording this property correctly. “The PIN is owned by Bower Gardens LLC, which is a registered business, and the main address for the business is the 18-32-403-009-0000 PIN. Thus, we believe the split class is justified.

“In reviewing the current valuation and classification of the property, we will change the property PIN to a 2-11 but the PIN will still have split building improvements (one with a 2-11 class and one with a 5-81 class). We have also revalued the industrial improvement for 2022 and a decrease of value was warranted.”

Hynes had inspected every one of these properties himself. “This is what the assessor would have seen had he bothered to send someone out. The prior administrations would have fixed this. They sent inspectors out to the field. Assessor Kaegi didn’t inspect any property in Lyons township during appeal season.”

Hynes said that on top of some taxpayers being overtaxed, and some being in a financial stranglehold because of county records, others may not be paying their fair share, or any at all.

There’s a house at 1307 W. 53rd Place in LaGrange Highlands that has been missing from the tax rolls for three years.

Hynes says this should be of concern to all taxpayers in Lyons Township.

“When property isn’t taxed correctly, it should be cause for concern for all that own property in that direct area.”

This property was inspected by our office in November 2021 and July 2022,” Smith said. “Our legal department is reviewing its options to issue an omitted assessment which would bill the property owner for any back taxes.”

The answer lies in the numbers, according to Hynes.

“There are over 1.5 million residential parcels in this county and 14 residential field inspectors employed to inspect them all. Mission: Impossible. The Cook County Assessor’s office is woefully understaffed to complete the most basic task required for an accurate assessment. Locate taxable property.”

“A 2019 International Association of Assessing Officers audit conducted at Assessor Kaegi’s request identified the number of inspectors required to generate an accurate assessment at 56. At the start of his term, Assessor Kaegi had 17. That number has since dwindled to 14. Curiously, the county board has given the office 18 budgeted positions for field inspectors yet one third of those positions have remained unfilled.”

“When I started working at the Cook County Assessor’s office during the Houlihan administration, the office had 49 residential inspectors and 1.3 million residential parcels. Those numbers were closely aligned with IAAO staffing standards. Each year, residential field inspectors completed new construction inspections during permit season, field checks during appeal season, and assessment inquiries to maintain county data. Today, on site field inspections are a rare occurrence.”

Smith said the Assessor’s Office is working on hiring new field inspectors and has already hired two new ones this summer.

Adrian Valladolid in front of his Summit business/residence.

Local News

Countryside puts dog park on hold, will require leashes in two parks

Spread the loveBy Steve Metsch The city of Countryside has put on hold building a dog park, but canines and their owners are still in store for a treat. The city council has unanimously approved a plan to permit dogs in City Park and Countryside Park this year. Previously, they were not allowed in the…

Bridgeview approves auto repair shop

Spread the loveMoves up time for May 1 village board meeting By Steve Metsch Bridgeview is getting a new automotive repair shop. The village board at its April 17 matinee meeting approved a special use permit that will allow a repair shop at 9010 S. Beloit Ave. There was no discussion among trustees. The board…

Summit Fire Department blood drive draws a crowd

Spread the loveBy Carol McGowan The Summit Fire Department, along with the Village of Summit, and the Argo Summit Lions Club held a blood drive this past Saturday, and it drew a crowd that even impressed the American Red Cross. It took place from 9 a.m. until 2 p.m. with non-stop donors walking through the…

Hodgkins toasts village businesses

Spread the loveBy Carol McGowan Hodgkins Mayor Ernest Millsap and the Board of Trustees celebrated the village’s businesses at its annual Business Appreciation Breakfast on April 10. Over 100 people gathered at the Hodgkins Administration Center for a hearty breakfast hosted by the village. Representatives from many businesses that are located in or that work…

First Secure Bank to host American Eagle gold coin sale

Spread the loveFrom staff reports First Secure Bank & Trust of Palos Hills announced its annual May sale of 1-ounce and ¼-ounce American Eagle Gold Coins, produced by the U.S. Mint, will take place from 10 a.m.to noon on Saturdays, May 4, May 11, May 18 and May 25. The sale will take place at…

Boys Volleyball | Richards weathering struggles after run of success

Spread the loveBy Xavier Sanchez Correspondent After a tough weekend at the Smack Attack tournament, Richards got back into the win column with a two-set victory over Eisenhower in a South Suburban Red match. The Bulldogs made quick work of the Cardinals, winning 25-16, 25-15 on April 23 in Oak Lawn to snap a five-match…

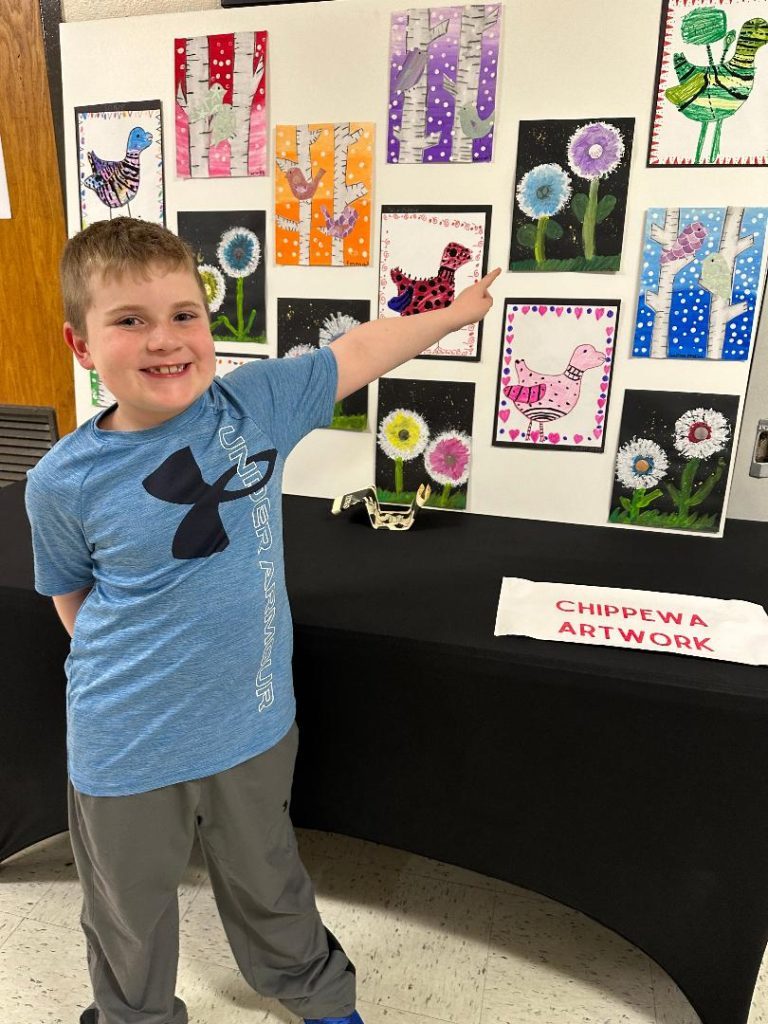

SD218 puts on annual Arts Extravaganza

Spread the loveBy Kelly White The arts have become a major portion of the curriculum Community High School District 218. Showcasing those many talents, the Friends of CHSD 218’s Education Foundation proudly hosted its 15th annual Arts Extravaganza on April 5 at Eisenhower High School in Blue Island. “The Arts Extravaganza is a great event…

Year of growth | Evergreen Park enjoying inaugural boys volleyball season

Spread the loveBy Xavier Sanchez Correspondent After almost 70 years of existence as a high school, Evergreen Park finally has a boys volleyball team. The Mustangs are playing their inaugural season with a junior varsity squad, with some matches being played at the varsity level. Head coach Brian Zofkie is leading this group with assistant…

Swanson scores, assists in Red Stars’ win over Reign

Spread the loveThe Red Stars improved to 3-1-1 by beating the Seattle Reign, 2-1, on the road on April 21. Mallory Swanson had an assist on an Ali Schlegel goal in the fourth minute and added a goal of her own in the 31st minute. Swanson missed last season after sustaining a knee injury on…

Neighbors

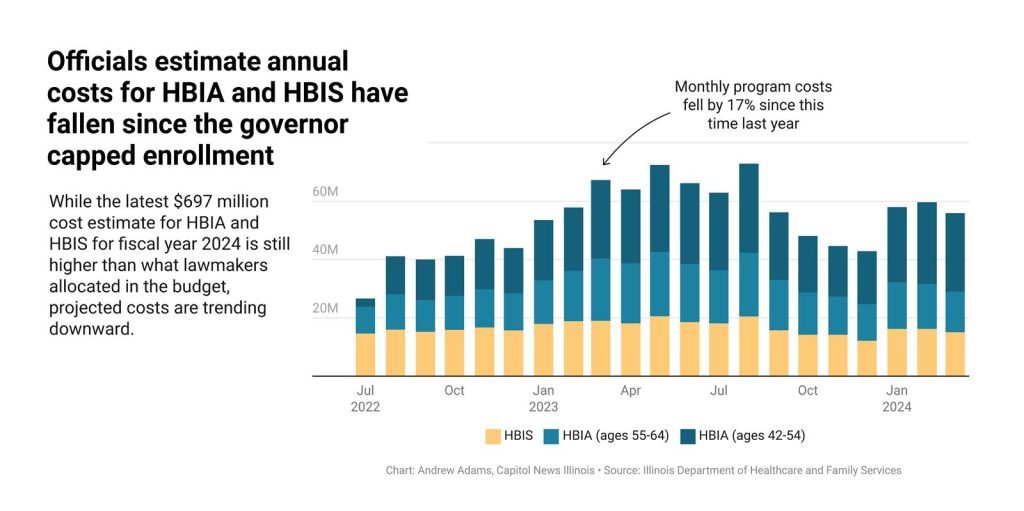

Immigrant advocates tout new report showing benefits of state-funded health plans

By PETER HANCOCK and JERRY NOWICKI Capitol News Illinois news@capitolnewsillinois.com SPRINGFIELD – Immigrant rights advocates on Friday continued to push for one of their top budget priorities: full funding for state-run health care programs that benefit noncitizens, regardless of their immigration status. Those programs offer health coverage for low-income individuals who would otherwise qualify for…

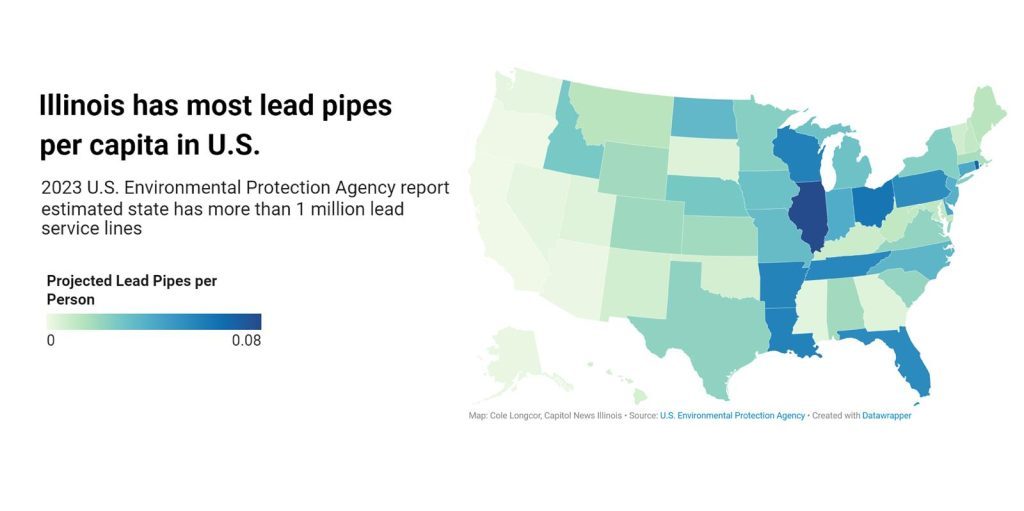

As state continues to inventory lead pipes, full replacement deadlines are decades away

By COLE LONGCOR Capitol News Illinois Clongcor@capitolnewsillinois.com Lead pipes in public water systems and drinking fixtures have been banned in new construction since 1986, when Congress amended the Safe Drinking Water Act, but they are still in use across the U.S. and in Illinois. The presence of lead pipes has persisted due in part to…

Capitol Briefs: State unveils report on racial disparities among homeless populations

By ANDREW ADAMS Capitol News Illinois aadams@capitolnewsillinois.com Tackling homelessness requires addressing racial injustice, according to a new report commissioned by the state’s Office to Prevent and End Homelessness. The report found that Black people are eight times more likely to experience homelessness than white people. Remedying this disparity, according to the report, would require “long-term…

Flooding is Illinois’ Most Threatening Natural Disaster. Are We Prepared?

by Meredith Newman, Illinois Answers Project April 16, 2024 This story was originally published by the Illinois Answers Project. The electricity in Mary Buchanan’s home in West Garfield Park was not working – again. The outage lasted four days, starting just after a crew dug up her front lawn to install a check valve in…

Bears pitch $3.2B stadium plan, but Pritzker still ‘skeptical’ despite team’s $2B pledge

By DILPREET RAJU & JERRY NOWICKI Capitol News Illinois news@capitolnewsillinois.com The Chicago Bears laid out a $3.2 billion plan for a new domed stadium on Chicago’s lakefront on Wednesday afternoon, painting pictures of future Super Bowls and other major public events while pinning their hopes on yet-to-be-had conversations with the governor and lawmakers. The Bears…

Regulators weigh future of gas industry in Illinois, while clamping down on Chicago utility

By ANDREW ADAMS Capitol News Illinois aadams@capitolnewsillinois.com CHICAGO – Natural gas is fueling a fight between consumer advocates, a powerful utility company and the state. Amid competing advertising campaigns, accusations of mismanagement and state decarbonization efforts, the Illinois Commerce Commission is starting a process that will shape how the state regulates the increasingly controversial industry. …

Komatsu mining truck named 2024 ‘coolest thing made in Illinois’

By COLE LONGCOR Capitol News Illinois Clongcor@capitolnewsillinois.com SPRINGFIELD – A mining truck manufactured by Komatsu was crowned the winner of the 2024 “Makers Madness” contest, earning the title of “the coolest thing made in Illinois” at the Governor’s Mansion Wednesday. The truck was one of more than 200 entries in the 5th annual contest hosted…

Giannoulias calls for disclosure of lobbyist contracts

By PETER HANCOCK Capitol News Illinois phancock@capitolnewsillinois.com SPRINGFIELD – For decades, lobbyists in the Illinois Statehouse have been required to report how much they spend wining, dining and entertaining lawmakers. Currently, though, there is no law requiring lobbyists to disclose how much they are paid by corporations, industry groups or other special interest organizations. That…

Illinois Senate advances changes to state’s biometric privacy law after business groups split

By HANNAH MEISEL Capitol News Illinois hmeisel@capitolnewsillinois.com SPRINGFIELD – It’s been more than a year since the Illinois Supreme Court “respectfully suggest(ed)” state lawmakers clarify a law that’s led to several multi-million-dollar settlements with tech companies over the collection of Illinoisans’ biometric data. On Thursday, a bipartisan majority in the Illinois Senate did just that,…

Illinoisans can now get documents notarized online

By ALEX ABBEDUTO Capitol News Illinois abbeduto@capitolnewsillinois.com Illinoisans who need a notary public can now access those services online through a new “E-Notary” portal launched by the secretary of state’s office. This process is one of the latest initiatives of Secretary of State Alexi Giannoulias’ ongoing effort to modernize the office and its services. Notaries…