Tammy Petrovich and her husband stand in front of their burned out home in Countryside (Photo by Carol McGowan)

Assessor promises to fix errors for Lyons Township taxpayers

By Carol McGowan

After lengthy delays, some lasting years, some property owners in Lyons Township are finally getting help from the Cook County Assessor’s Office in fixing faulty property tax bills.

Property owners that the Desplaines Valley News had been in touch with were just looking for fairness in what they were supposed to be paying in property taxes.

Taxpayers in Willow Springs, Countryside, and Summit, to name just a few, said they were being taxed unfairly, and were unable to get relief or even answers from the Cook County Assessor’s Office.

Their complaints were real, according to Lyons Township Assessor Patrick Hynes.

Steve Slas sits on the porch of his home in Willow Springs.

According to Hynes, the Cook County property tax system relies on an accurate physical description of each parcel subject to ad valorem taxation. What improvements are on each parcel? Is it an office high rise, industrial building, auto repair shop, single-family home? The only person tasked with maintaining and keeping these descriptions is Cook County Assessor Fritz Kaegi.

Part of the problem is that there are several layers to the Cook County property tax system. There’s the township assessor, Cook County Assessor, Cook County Board of Review, PTAB, Cook County Clerk, and Cook County Treasurer, said Hynes.

“If each agency kept their own books and their own property descriptions, there would be chaos in the system. So, one and only one is tasked with that job, Cook County Assessor Fritz Kaegi. The others are not empowered to correct erroneous property descriptions,” Hynes said.

“Discover, list and value are the three primary functions of the Cook County Assessor’s office,” Hynes said. “That’s property tax 101 when you start working toward certifications in this field. Discover: Identify there’s a building on a parcel. List: Describe the characteristics of that building for mass appraisal, create a property record card, and add these features to the public record. Value: Generate an estimate of the most probable market value. We’re having problems with the first two functions.”

Hynes said an audit of the Cook County Assessor’s office, conducted by the International Association of Assessing Officers, determined the office was woefully understaffed to maintain property records.

“They recommended the office employ 56 residential field inspectors. Today, the office has 14. As a result, only a portion of new construction in Cook County has been added to the tax rolls the prior three seasons. This problem is countywide, but I’m concerned with cleaning up Lyons Township.”

“When I took office, I started an audit of the property record cards maintained by Assessor Kaegi. I quickly discovered several new construction homes that were completed, occupied for years and never added to the tax rolls. I am 25 percent complete auditing the records. I have discovered $25 million in missing assessments. I estimate $100 million is missing townshipwide, and billions countywide.”

“I have identified these missing assessments and sent them to Assessor Kaegi’s office. They were too busy catching up with the 2021 assessment to add my missing property to the tax rolls. So, I went out and sketched them for him and submitted property record cards. Still, not added to the tax rolls. Very frustrating.”

Hynes told the Desplaines Valley News, “The property records maintained by the County Assessor are not just incomplete, but also rife with errors. Each taxpayer has an opportunity to complain about errors in their property description at appeal season. Every taxpayer who filed an appeal in my township with the Cook County Assessor this season requesting a correction in an erroneous property description was ignored. We did not receive any field checks or property record card updates this year in Lyons during appeal season, as has been office practice the prior three administrations.”

“Assessor Kaegi’s office is the only place these taxpayers can seek relief, because only Assessor Kaegi can change a property description,” he said.

Scott Smith, Chief Communications Officer for the Assessor’s Office, said Kaegi was aware of the problem and has been working to correct the problems.

“The IAAO report, released in 2019, found the office was understaffed for the number of parcels it assesses (1.9 million). The report also noted we had one-quarter of the field staff needed to inspect properties. Moreover, the office had not been using advances in technology to review and update parcels,” Smith wrote in an email.

“Because of this, there has been a backlog of inspections and updates to current properties. Property owners should know that in the past three-and-a-half years, the Assessor’s Office has significantly closed the staffing and technology gaps in our office.

“In 2020, 26% of our new hires were in our valuations department, which handles field inspections and property characteristics updates. In 2021, we built out a new data integrity unit which is tasked with ensuring we have up-to-date information on all properties.

“Since the IAAO audit in 2019, we have implemented 19 of their recommendations and moved forward on technology plans in 4 other recommended areas.”

Hynes highlighted examples of property owners who are being unfairly taxed.

One was Tammy Petrovich, a young mom with young kids.

Her home, at 7000 Golfview Road in Countryside, had a catastrophic fire in April of 2021, rendering it uninhabitable. She filed an appeal with the Cook County Assessor seeking relief, including photos, fire report, and insurance adjuster report. She requested a field check, but no field check had been done and her appeal was denied. There’s been no change in the property record card. She’s being erroneously taxed on a destroyed home.

Work on the house has recently started, but her and her family have not been able to live in the gutted house since the fire as it was completely burned out.

After checking into her case, Smith said, “The value on this property has been corrected for 2021, so it reflects the inhabitability. The property owner’s tax bill will be reduced to reflect that information. The appeal should have been approved in 2021.”

Then there’s a young restauranteur, at 6254 Archer in Summit. His name is Adrian Valladolid. He has an erroneous description on his property record, resulting in $30,000 in excess taxation.

Valladolid lives in the apartment above his restaurant and is being charged commercial rates when he qualifies for class 2-12 at residential rates. A change would require a field inspection, yet after repeatedly requesting a field inspection for three years, he was told he could not get one.

Valladolid says it’s hard to stay afloat because of the money he needs for taxes that he shouldn’t even be paying.

“I’m struggling and still recovering because of COVID. I’m trying to keep my doors open. As everyone knows, it’s hard to find people to work. I interview them, then many want so much more money than I can do right now. If I wasn’t paying more in taxes than I should, I would have that much more to pay employees and put into my business. It’s rough.”

“Apartment units appear to have been placed on top of the restaurant in 2016-2017,” Smith said. “Our records do not currently have apartments on the PIN so we inspected the property this week and we will revisit the classification decision.” He did add that 2-12s must measure less than 20,000 square feet.

Another taxpayer, Vida Rivoli, 4252 Joliet Road in Lyons, had been trying to get answers for three years.

Rivoli was being charged for a commercial space but owns a residential condo. She filed an appeal requesting a property description change without success.

She purchased a residential condo listed on the MLS as such and had no idea what was waiting for her. She has appealed annually, petitioned her condo board for a declaration that no commercial use is allowed in her building. She fought for a special session at the Village of Lyons to rezone the parcel residential use only. Nothing has worked.

Smith had good news for her. “After reviewing the property, there is adequate documentation to warrant a class change from 5-99 to 2-99. The residential department has corrected the classification for 2022, issued a recommendation to the Board of Review for 2021, and issued a Certificate of Error for 2018, 2019, and 2020. A property tax refund will then be issued.”

Then there is Steve Slas, 115 Willow Springs Road, Willow Springs.

Slas has an older two-flat assessed as an industrial building. He appealed and requested a field check. No field check had been performed. He did receive a letter from the Cook County Assessor claiming there had been a field check. FOIA requests and direct questioning by the township assessor revealed there was no field check conducted. As a result, there has been no change in his property record. He pays $15,485 in excess taxation.

The Desplaines Valley News met with Slas at his property. He had piles of correspondence and box of paperwork that he’s been keeping since trying to get his tax issue resolved. It’s not something new. He’s been dealing with this and paying way more than he should since 2008.

Slas may be on the verge of losing his property because of a paperwork error, and he can’t get a simple field check that would help him keep it.

After years of overpaying, it’s hard for him to keep doing it.

Hynes contacted the Cook County Assessor’s Office, and was told there was a desk review in lieu of a physical field check.

That’s it, no further explanation, and Slas is still waiting for the correction to be made.

Slas told the DVN: “I have spent thousands of dollars and hundreds of hours along with the Lyons Township Assessor Patrick Hynes, providing the appropriate documentation in an effort to pay my fair share of property taxes since 2008. In our latest 2021 appeal, Mr. Kaegi’s rejection letter states, ‘They have reviewed our documentation, did a field inspection and a market analysis of my home.’ Through the freedom of information act and a friendly call by Mr. Hynes, we found no field inspection took place, the most recent notes on file are pre-2008 and there was no mention of our requested classification change.”

“This one was a little complicated,” Smith said. “This PIN has two separate building improvements that have different classes. The main property PIN has been classified as an industrial building. The residential improvement is classified as a 2-6 unit apartment and has been classified as a 2-11 for the past 10+ years. Additionally, the land has been valued as 50 percent commercial land (500 Class) and 50 percent residential land (200 Class). So, we have been recording this property correctly. “The PIN is owned by Bower Gardens LLC, which is a registered business, and the main address for the business is the 18-32-403-009-0000 PIN. Thus, we believe the split class is justified.

“In reviewing the current valuation and classification of the property, we will change the property PIN to a 2-11 but the PIN will still have split building improvements (one with a 2-11 class and one with a 5-81 class). We have also revalued the industrial improvement for 2022 and a decrease of value was warranted.”

Hynes had inspected every one of these properties himself. “This is what the assessor would have seen had he bothered to send someone out. The prior administrations would have fixed this. They sent inspectors out to the field. Assessor Kaegi didn’t inspect any property in Lyons township during appeal season.”

Hynes said that on top of some taxpayers being overtaxed, and some being in a financial stranglehold because of county records, others may not be paying their fair share, or any at all.

There’s a house at 1307 W. 53rd Place in LaGrange Highlands that has been missing from the tax rolls for three years.

Hynes says this should be of concern to all taxpayers in Lyons Township.

“When property isn’t taxed correctly, it should be cause for concern for all that own property in that direct area.”

This property was inspected by our office in November 2021 and July 2022,” Smith said. “Our legal department is reviewing its options to issue an omitted assessment which would bill the property owner for any back taxes.”

The answer lies in the numbers, according to Hynes.

“There are over 1.5 million residential parcels in this county and 14 residential field inspectors employed to inspect them all. Mission: Impossible. The Cook County Assessor’s office is woefully understaffed to complete the most basic task required for an accurate assessment. Locate taxable property.”

“A 2019 International Association of Assessing Officers audit conducted at Assessor Kaegi’s request identified the number of inspectors required to generate an accurate assessment at 56. At the start of his term, Assessor Kaegi had 17. That number has since dwindled to 14. Curiously, the county board has given the office 18 budgeted positions for field inspectors yet one third of those positions have remained unfilled.”

“When I started working at the Cook County Assessor’s office during the Houlihan administration, the office had 49 residential inspectors and 1.3 million residential parcels. Those numbers were closely aligned with IAAO staffing standards. Each year, residential field inspectors completed new construction inspections during permit season, field checks during appeal season, and assessment inquiries to maintain county data. Today, on site field inspections are a rare occurrence.”

Smith said the Assessor’s Office is working on hiring new field inspectors and has already hired two new ones this summer.

Adrian Valladolid in front of his Summit business/residence.

Local News

McCord shows off Stagg student artworks

Spread the loveBy Kelly White Stagg High School art students proudly had their work showcased at a local gallery. McCord Gallery & Cultural Center, 9602 W. Creek Road, Palos Park, featured the art of Stagg’s most creative until January 28. “Having my work as part of an art show in an art gallery like McCord is significant to…

No injuries when Metra train hits school bus in Orland Park

Spread the loveBy Bob Bong No children were injured Friday afternoon when their school bus stalled on railroad tracks in Orland Park and the bus was hit by a Metra commuter train. The Orland Fire Protection District responded to an emergency call Friday when a school bus from American School Bus Co. carrying students from…

Worth hires new management for Water’s Edge Golf Course

Spread the loveBy Joe Boyle Even an impending snowstorm could not damper the mood of Worth Trustee Laura Packwood regarding plans for the village’s Water’s Edge Golf Course. Packwood, who is the head of the golf committee, said that Orion, a company based out of Kansas City, Mo., became the official managers of Water’s Edge…

Cook County residents eligible for spay/neuter discounts in February

Spread the lovePet owners can bring their dogs and cats to participating veterinarians throughout Cook County to receive a $40 discount on spay or neuter services in February. The Cook County Department of Animal and Rabies Control are offering the spay and neuter program during February – Spay and Neuter Awareness Month. More than 200…

Teen driver charged in crash that killed Alsip girl

Spread the loveBy Bob Bong A juvenile was charged by Palos Heights police Monday with reckless homicide and reckless driving in the December 27 crash that killed a 14-year-old girl from Alsip and injured six other people. Palos Heights police did not identify the juvenile because of the driver’s age. The driver was charged with…

Cook County Animal and Rabies Control offers pet safety tips

Spread the loveParts of Cook County could see up to 12 inches of snow over the next day as a winter storm moves across the area starting tonight. Cold weather creates hazardous conditions for residents and their pets. The Cook County Department of Animal and Rabies Control reminds residents to take special precautions to keep…

Winter storm could bring heavy snowfall

Spread the loveParts of Cook County could see up to 12 inches of snow over the next day as a winter storm moves across the area starting tonight. The county’s Department of Transportation and Highways is monitoring conditions and has resources on standby to keep the 1,500 lane miles the county maintains, safe for drivers.…

District 230 waits for judge’s decision on mask mandates

Spread the loveBy Jeff Vorva Stagg and Sandburg students, parents and teachers are awaiting the decision of a Sangamon County judge to find out if there is any change in the mask mandate. District 230 was one of 145 districts in the state taken to court by parents who are against the mandate and believe…

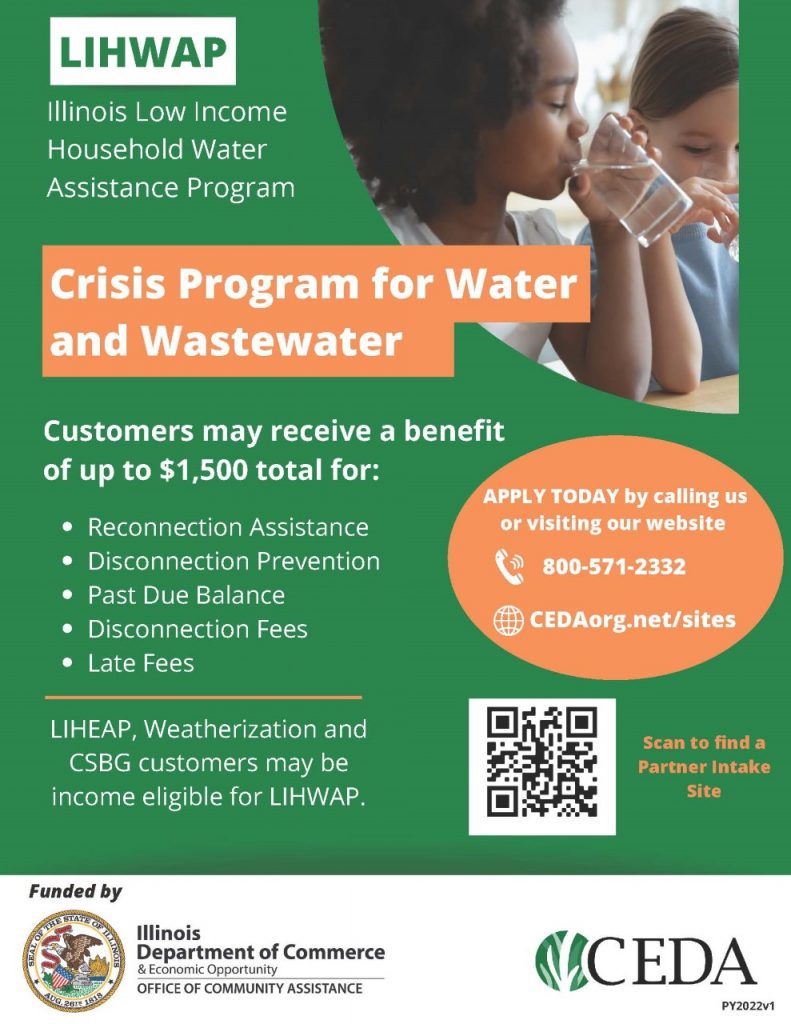

Summit approves deal with CEDA for water assistance

Spread the loveBy Carol McGowan Help may be on the way for some Summit residents that have trouble paying their water bills. The Summit Village Board recently approved an ordinance authorizing an agreement by, and between the Community and Economic Development Association of Cook County. It’s a vendor agreement for the Low-Income Household Water Assistance…

Willow Springs hires Grace as village administrator

Spread the loveBy Steve Metsch Citing his experience in Lyons, Willow Springs Mayor Melissa Neddermeyer said Ryan Grace was the best of five finalists interviewed for the job of village administrator. Grace, 38, had been public works director in Lyons the past four years, working on a wide range of village issues and events in…

Neighbors

Pritzker pledges to expand access to mental health care in Illinois

By DILPREET RAJU Capitol News Illinois draju@capitolnewsillinois.com SPRINGFIELD – In the middle of Mental Health Awareness Month, Gov. JB Pritzker and Lt. Gov. Juliana Stratton hosted a panel in Springfield this week at which he pledged to expand the state’s behavioral health services. With several dozen services providers from around the state in attendance, Pritzker…

With 1 week left in session, Pritzker admin says all revenue options remain on the table

By JERRY NOWICKI Capitol News Illinois jnowicki@capitolnewsillinois.com While the governor’s office instructed its agency directors to prepare for $800 million in potential budget cuts last week, all facets of his plan to raise $1.1 billion in revenue to avoid those cuts remain under consideration. Read more: ANALYSIS: ‘Significant enough’ opposition to Pritzker’s revenue plan leads to…

Illinois launches summer food assistance program

By PETER HANCOCK Capitol News Illinois phancock@capitolnewsillinois.com SPRINGFIELD – The state is launching a new program to provide food assistance during the summer for families with children who qualify for free or reduced-price meals at school. Gov. JB Pritzker joined other state officials and the U.S. Department of Agriculture Thursday to announce that Illinois will…

Lawmakers consider tax break for news publishers, state-sponsored journalism scholarships

By ALEX ABBEDUTO & ANDREW ADAMS Capitol News Illinois news@capitolnewsillinois.com SPRINGFIELD – A new measure being debated in the Illinois General Assembly would create a tax credit for certain news publishers based on the number of reporters they employ. The proposal from Sen. Steve Stadelman, D-Rockford, is part of a package of policies that he…

House gives OK to new state agency focused on early childhood programs

By PETER HANCOCK Capitol News Illinois phancock@capitolnewsillinois.com SPRINGFIELD – The Illinois House gave final passage Thursday to a bill establishing a new cabinet-level state agency whose mission will be to provide a kind of one-stop shop for services focusing on early childhood development and education. By the time it’s fully operational in 2026, the new…

As vacated Centralia funeral home prepares for new tenant, owner makes a startling find

By BETH HUNDSDORFER Capitol News Illinois bhundsdorfer@capitolnewsillinois.com In the basement of a Centralia funeral home in a dark hallway off the embalming room, tucked inside a nook behind two steel plates and a door, a visitor found three disembodied, neatly wrapped human legs, two of them marked with names and dated to the 1960s. The…

Illinois Supreme Court considers expectation of privacy in hospitals

By DILPREET RAJU & ANDREW ADAMS Capitol News Illinois news@capitolnewsillinois.com SPRINGFIELD – While Cortez Turner was in a hospital room being treated for a gunshot wound to his leg in 2016, police took his clothes. Now, the Illinois Supreme Court is weighing whether that action violated Turner’s expectation of privacy under the Fourth Amendment. The…

Capitol Briefs: House OKs program for student teacher stipends – but not the funding for it

By PETER HANCOCK & ANDREW CAMPBELL Capitol News Illinois news@capitolnewsillinois.com SPRINGFIELD – The Illinois House approved a bill Tuesday to allow student teachers to receive stipends while earning their education degree, even though the money needed to fund those stipends is unlikely to be included in next year’s budget. House Bill 4652, by Rep. Barbara…

As Medicaid redeterminations restart, about 73% of state’s recipients remain enrolled

By DILPREET RAJU Capitol News Illinois draju@capitolnewsillinois.com About 73 percent of Illinois’ Medicaid recipients remain on the rolls after the first redetermination cycle following the COVID-19 pandemic, while approximately 660,000 recipients have been disenrolled. Speaking at a news conference in Chicago, Gov. JB Pritzker celebrated the fact that 2.6 million Illinoisans remained on the rolls…

Capitol Briefs: Republicans sue over law banning legislative candidate slating

By HANNAH MEISEL Capitol News Illinois hmeisel@capitolnewsillinois.com One week after Gov. JB Pritzker signed an elections-related measure that his fellow Democrats quickly muscled through the General Assembly, Republicans sued over the new law, alleging the majority party is blocking ballot access to would-be legislative candidates. The law , passed early this month as the legislature’s…